July's national manufacturing purchasing managers index (M-PMI) will be released on Monday. Will investors cheer it?

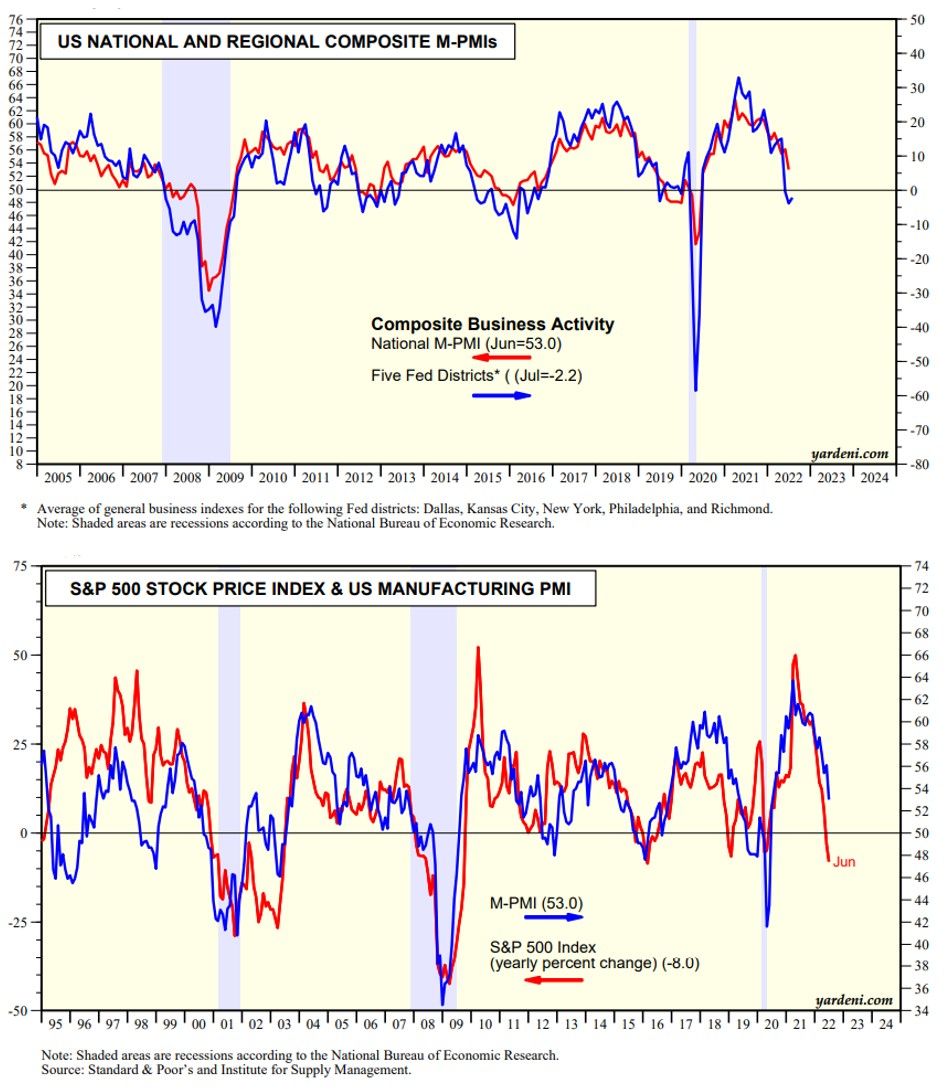

The regional business surveys conducted by five of the 12 Federal Reserve district banks suggest that the M-PMI should fall closer to 50.0 from June's 53.0 (chart below). The M-PMI's prices-paid index, which remained very high at 78.5, should also moderate somewhat, according to the regional surveys.

As we have previously shown, the growth rate in S&P 500 operating earnings on a y/y basis is highly correlated with the M-PMI. So is the yearly percent change in the S&P 500, which was down 8.0% last month (chart below). An M-PMI reading of 50.0 would suggest that the S&P 500 should be unchanged from a year ago when it was 4395.

The stock market continues to rally off its June 16 low. Investors seem to be discounting that a mild recession and moderating inflation might end the Fed's monetary policy tightening cycle sooner rather than later. In this scenario, earnings could flatten for a while, but not take a dive. We agree with this scenario, but would be concerned if valuation multiples rebound too quickly since the inflation outlook remains uncertain.