We've been betting on the resilience of the US economy and earnings to keep the bull market going. Our thesis has been challenged by a rash of weak economic indicators for January recently. We think that they will be stronger in February and March, as we've discussed in recent days.

However, Trump's tariffs imposed today on Canada, China, and Mexico could have stagflationary consequences for all concerned if they are not soon lowered or removed. As a result, we are raising our subjective odds of a what-could-go-wrong outcome for the economy and the stock market from 20% to 35%. We are reducing the likelihood of a meltup/meltdown scenario from 25% to 10%. We are keeping our Roaring 2020s scenario at 55%, and maintaining our year-end targets for the S&P 500 of 7000 this year, 8000 in 2026, and 10,000 in 2029.

Of course, we reserve the right to change our minds as often as the President of the United States does. Indeed, after the market close, Commerce Secretary Howard Lutnick said on Fox Business that compromises with Canada and Mexico will likely be revealed as soon as Wednesday! Go figure.

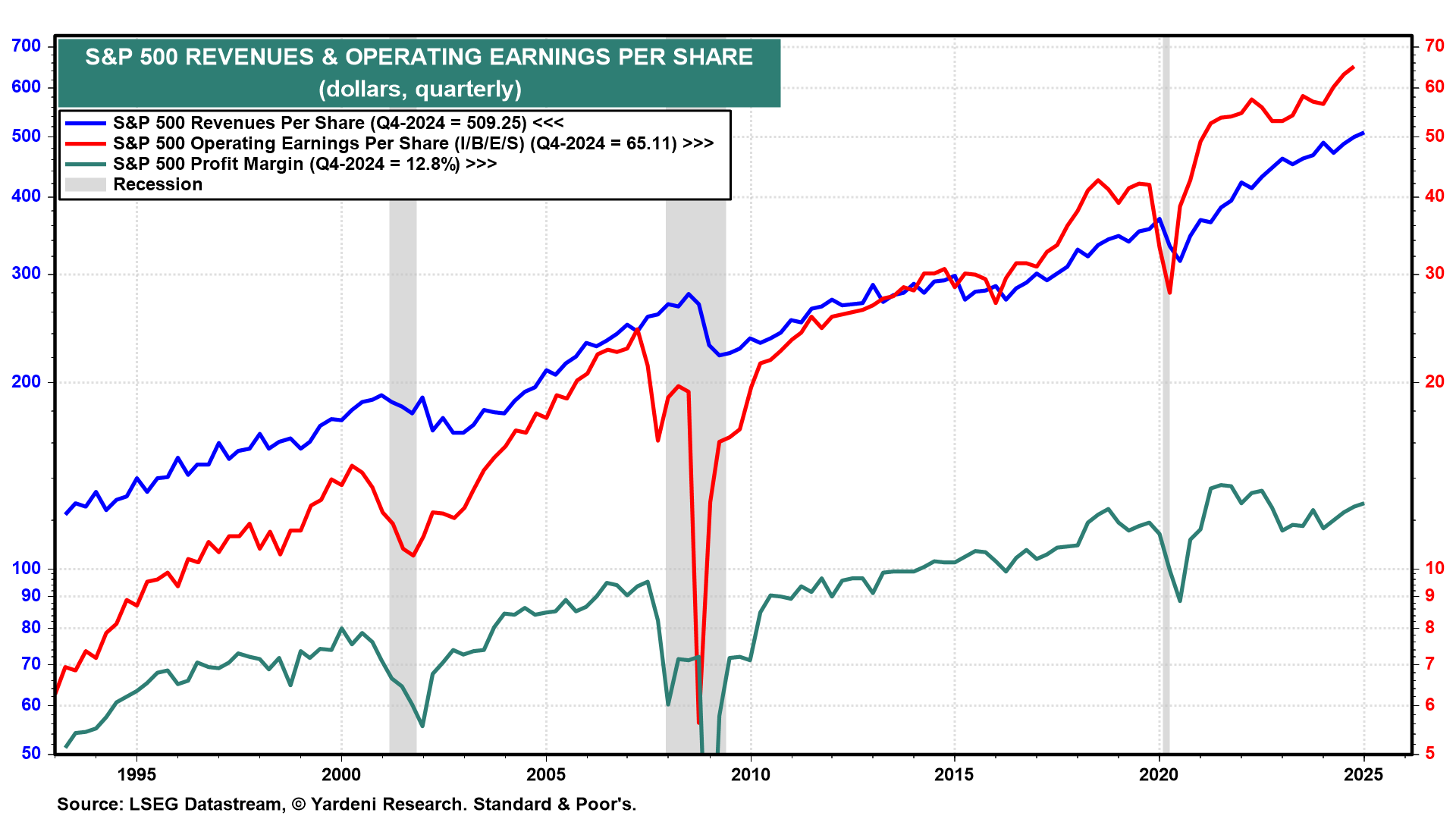

If the economic data up ahead confirm our upbeat assessment of the economy, then earnings should increasingly drive the stock market higher. Our colleague Joe Abbott reports that complete Q4-2024 data are now available for S&P 500 companies’ aggregate revenues per share (RPS), earnings per share (EPS), and profit margin.

(1) RPS and EPS rose to record highs, and the profit margin edged up to 12.8% (chart).

(2) RPS rose 3.9% y/y, slightly below the 4.4% average over time (chart). It should continue to grow around 4.0% this year.