Our mantra since the start of the banking crisis on March 10 has been that any day without a banking crisis is a good day for the stock market. Now our mantra is that any week without a banking crisis is a good week for the stock market. It was a good week for stock prices last week, especially on Friday, even though First Republic Bank continued its meltdown, which has been a "known known" since the crisis started. The "known unknown" is whether the crisis will spread despite the liquidity facilities provided by the Fed to avoid further bank runs. So far so good: the crisis seems to have been contained.

Nevertheless, it ain't over until it's over. The members of the FOMC could still make a mess of the situation by continuing to vote to tighten monetary policy. We think they will announce a pause in rate hiking at the May 2-3 meeting of the committee. But they've surprised us before with their hawkishness.

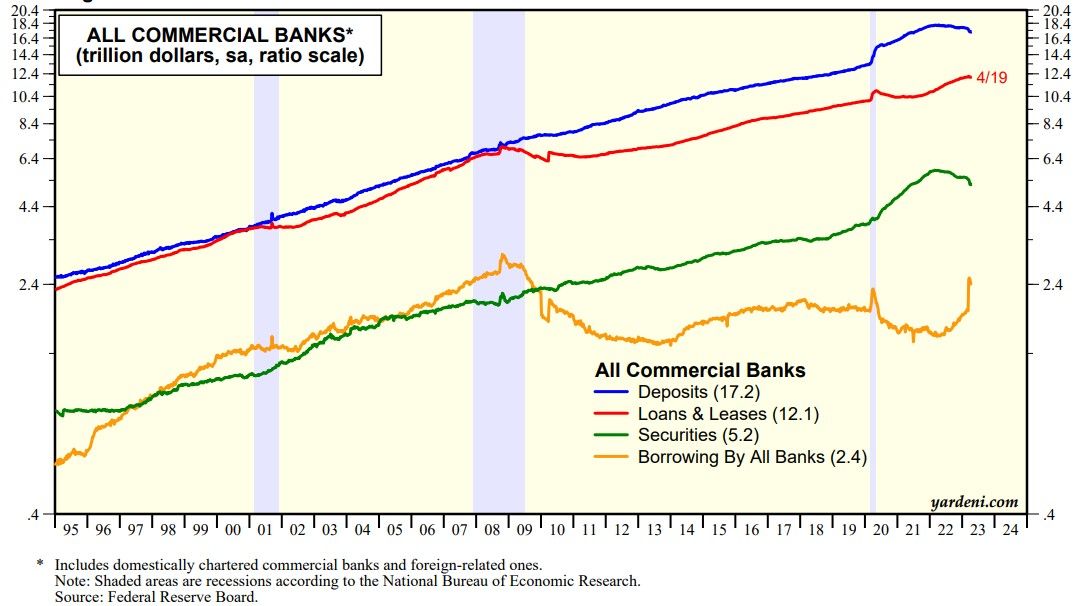

For now, we continue to monitor the H.8 data released by the Fed on Fridays at 4:15 p.m. on the assets and liabilities of the commercial banking system (chart). The April 19 data show that loans, securities, and deposits all edged up during the week, while borrowings edged down.

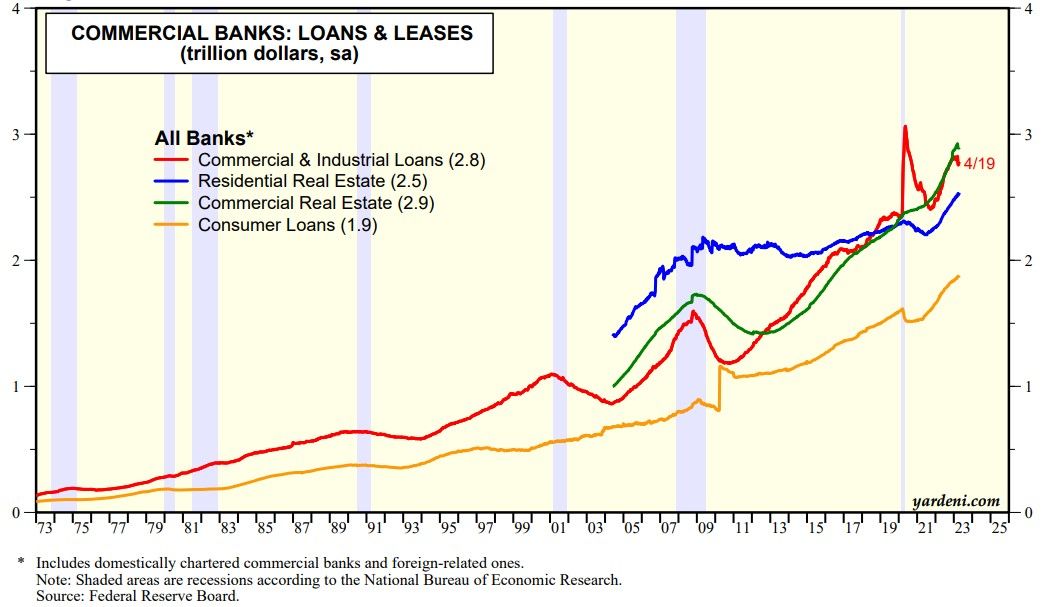

The loans data show that consumer loans and residential mortgages edged up to record highs (chart). On the other hand, C&I loans and commercial real estate loans may be peaking from their recent record highs. Our bottom line is that it doesn't add up to a credit crunch so far.

Next week on Monday, the Fed will release its Q1 Survey of Senior Loan Officers. It will undoubtedly show that credit conditions have tightened since the end of last year. Bonds may like that news, while stocks probably won't like it. Even though the report will be released a few days after next week's FOMC meeting, the survey will undoubtedly be available to the committee and should pursued them to pause.

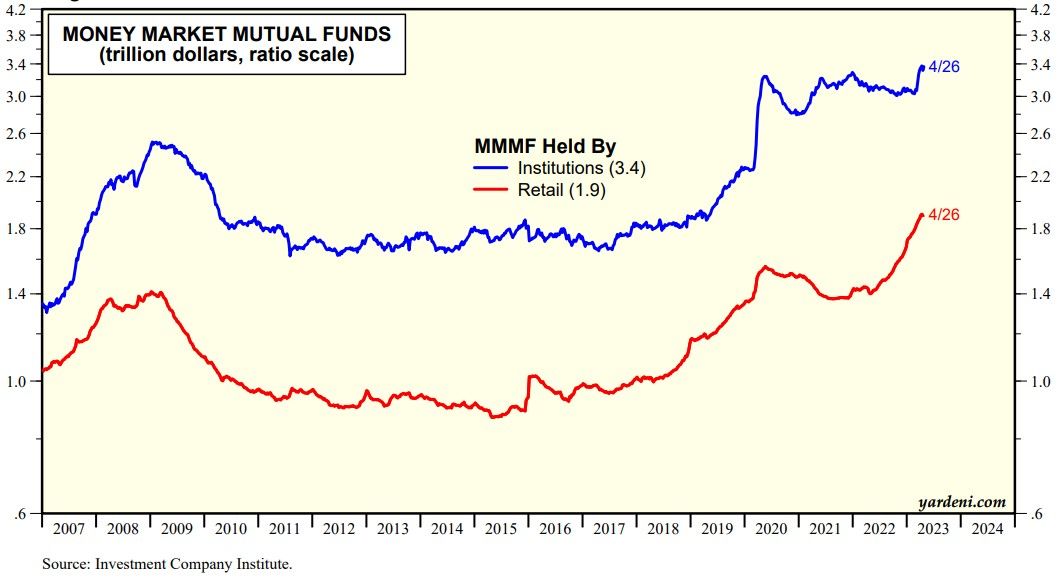

By the way, the good news is that the outflows from bank deposits to money market mutual funds (MMMF) might have started to slow in late April (chart).

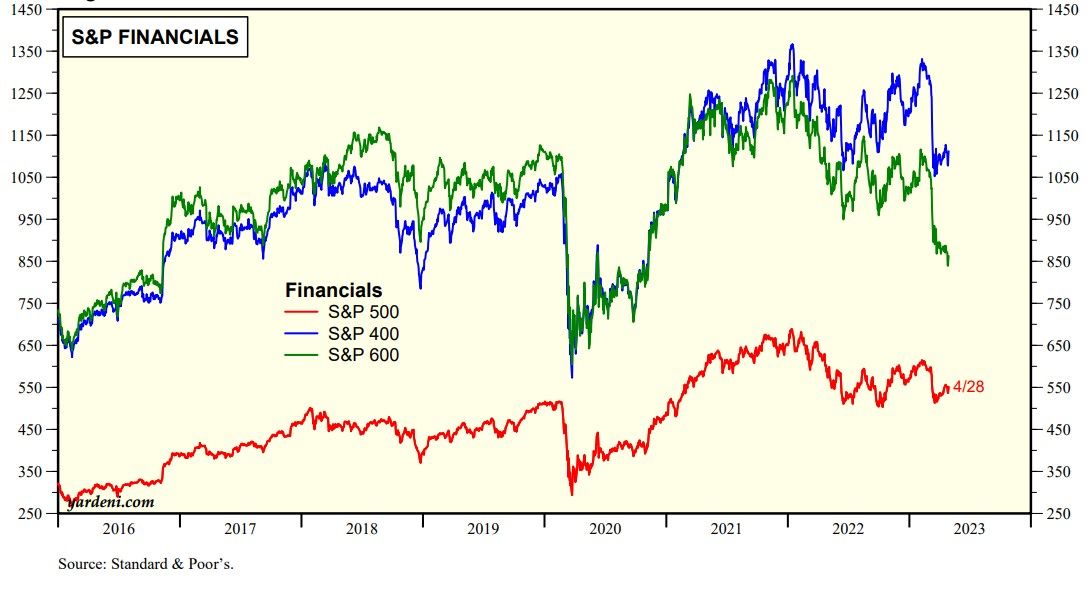

Meanwhile, the Financial sector of both the S&P 500 and S&P 400 seem to be bottoming, while the S&P 600 Financials have yet to bottom (chart). This may be a good pond to go fishing for small banks that are likely to be acquired.