The stock market is in the midst of another growth scare, in our opinion. The latest batch of economic indicators has been weak. The current growth scare is reminiscent of last summer's scare. It is just as likely to pass if the next batch of economic indicators improves, as we expect. That still leaves policy uncertainty under Trump 2.0 to spook stock investors. We still expect that stock prices may continue to be choppy through mid-year before climbing to new record highs later this year on solid economic and earnings growth.

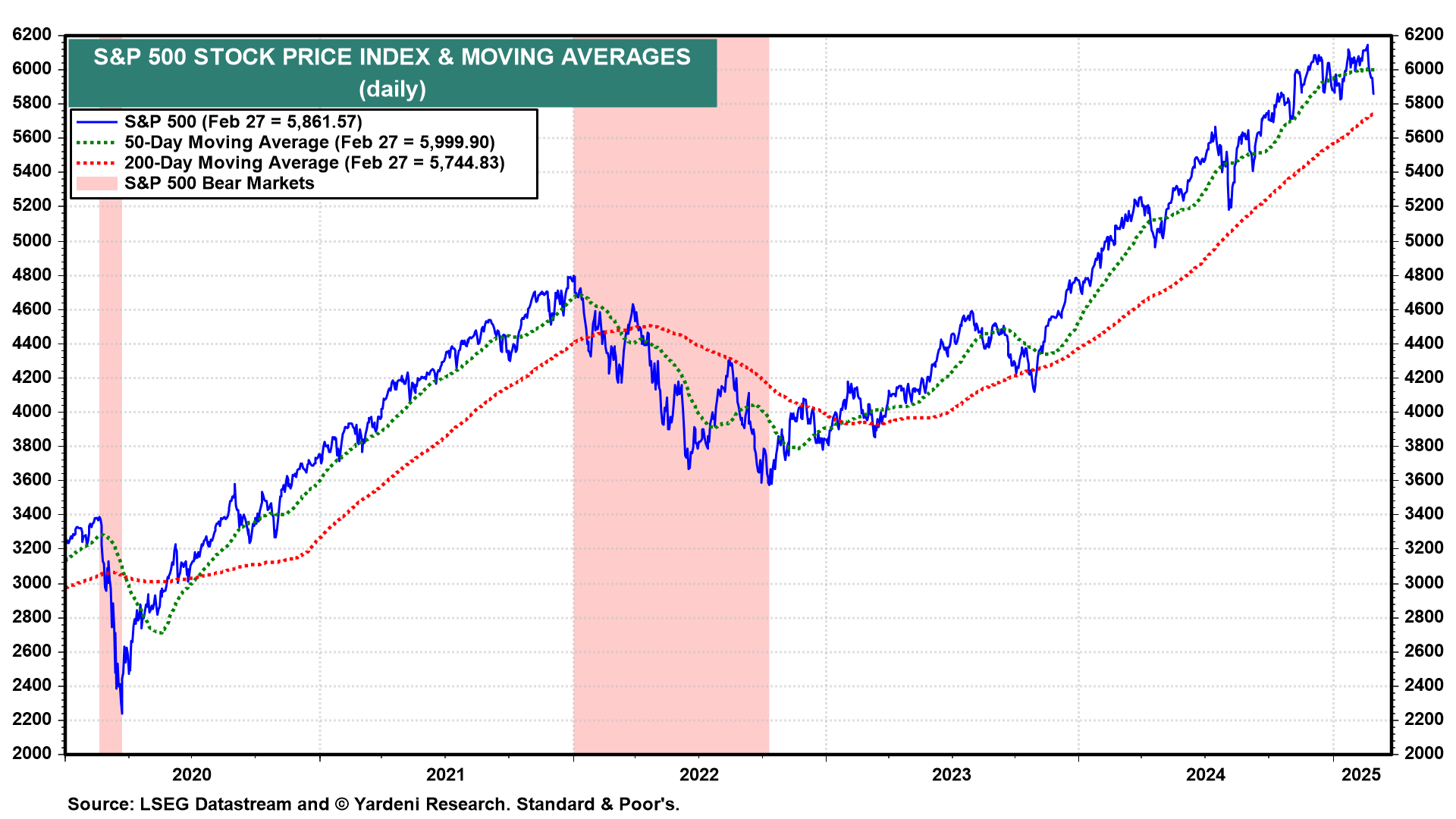

The S&P 500 is down 4.6% from its record high on February 19 and well below its 50-day moving average (chart). It might revisit its 200-day moving average on this pullback.

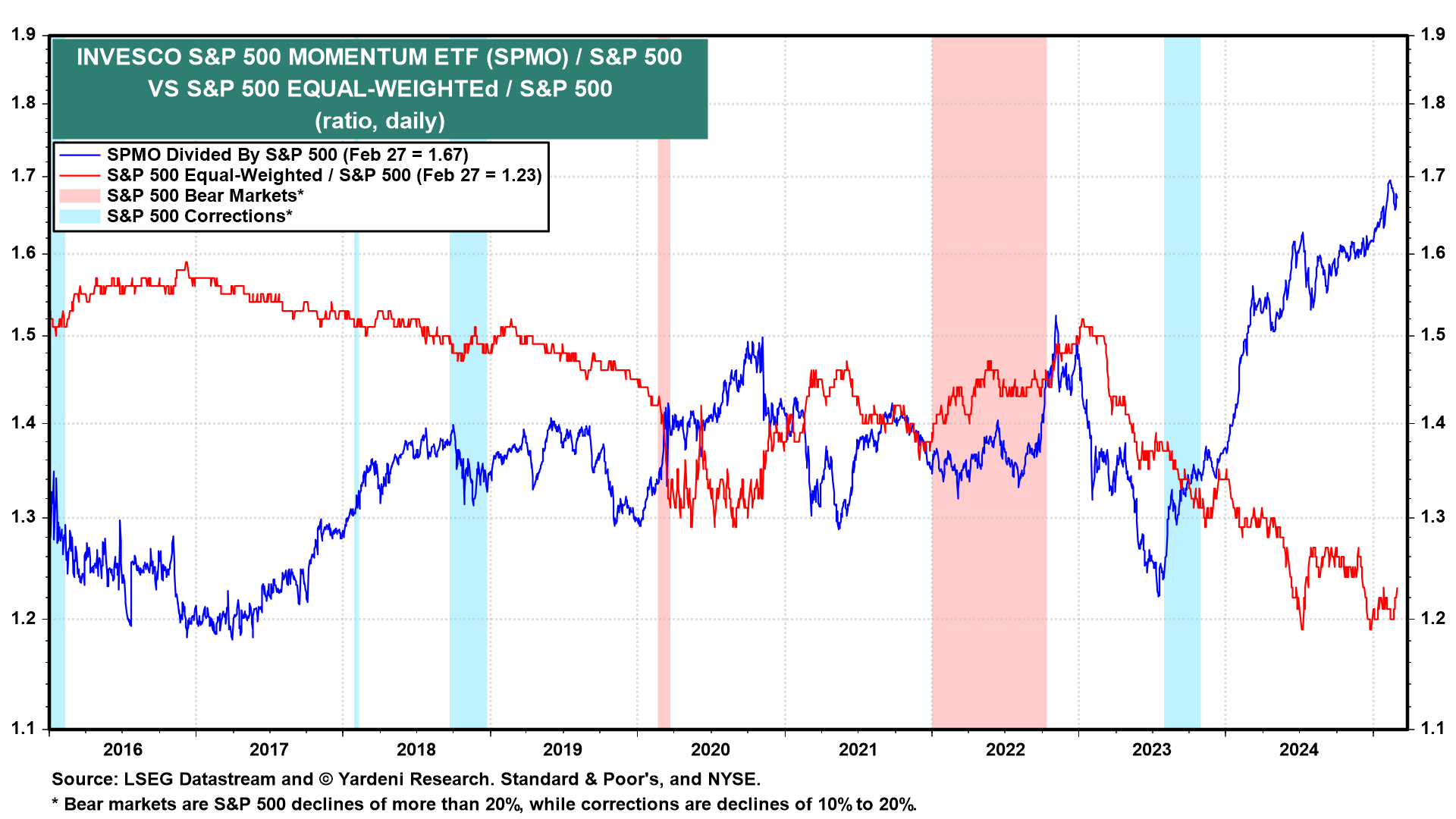

Much of the selloff since last Wednesday's record high has been led by momentum stocks, especially the Magnificent-7 (chart).

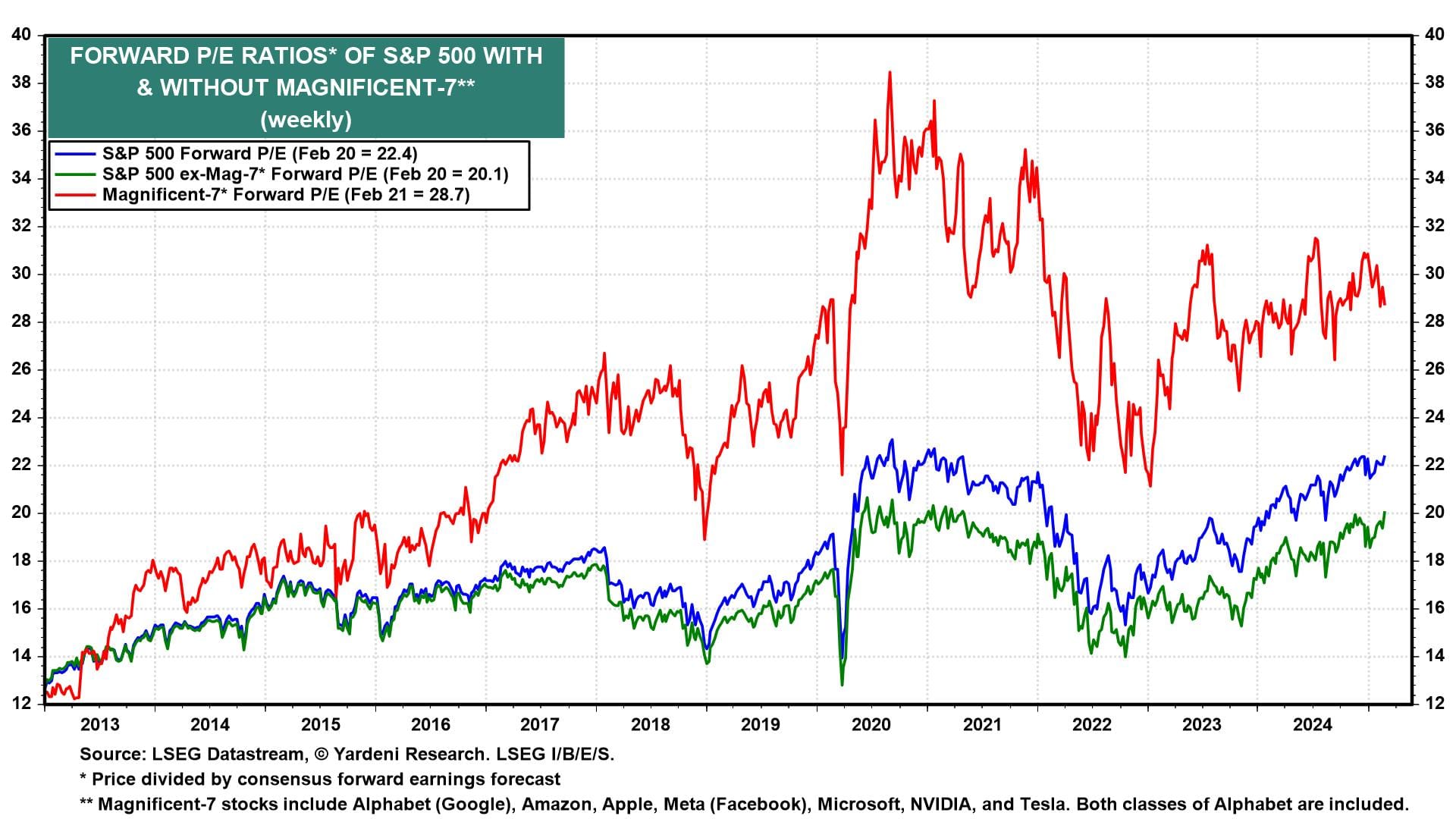

Despite the soft patch of economic data and policy uncertainty, there has also been a rotation trade away from the Magnificent-7 and into the S&P 493 in recent weeks, as we expected at the start of this year. This rotation can be seen in the recent decline of the forward P/E of the Magnificent-7 and the ascent of the forward P/E of the S&P 493 (chart).

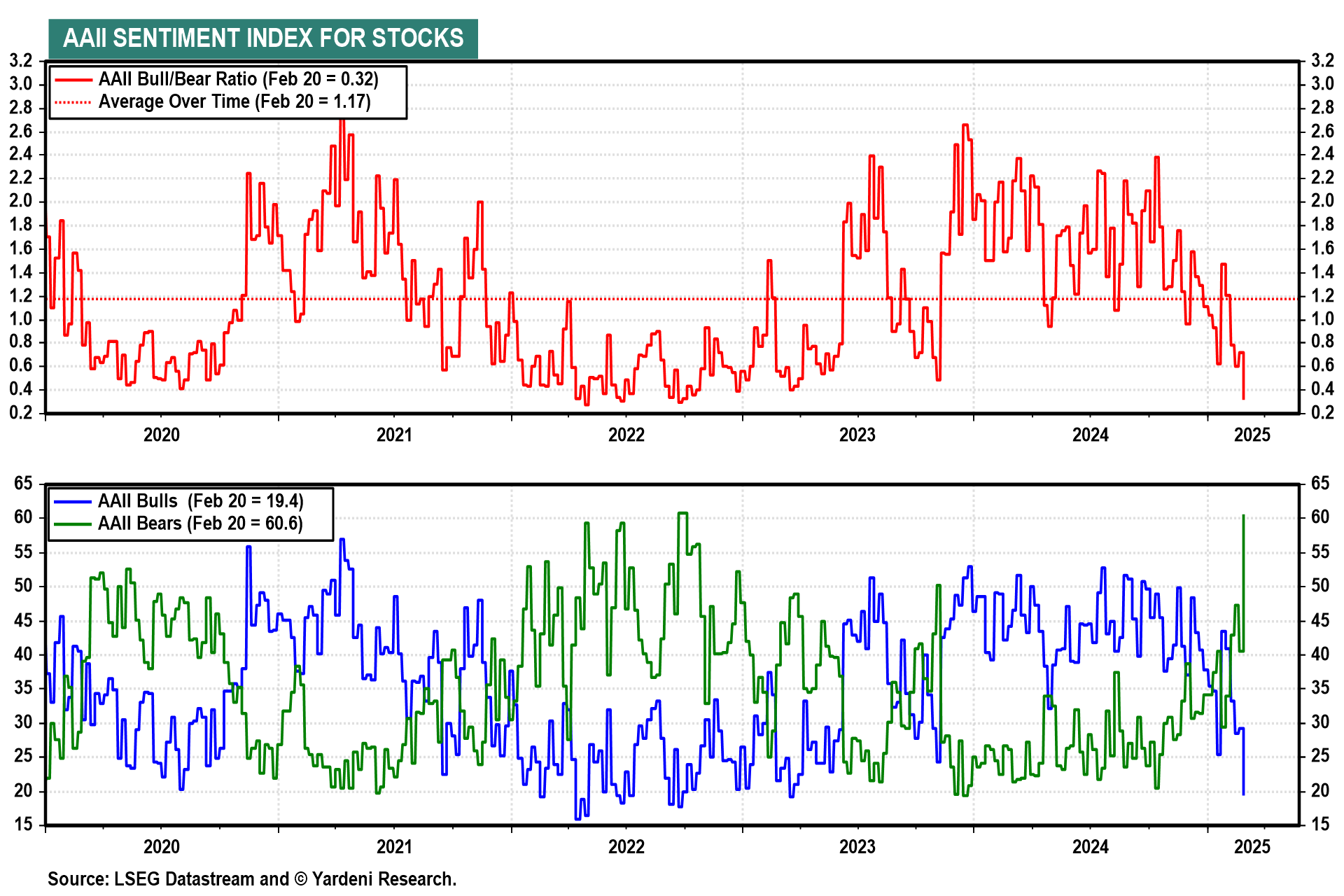

In any event, stock investors have turned very cautious in recent days. AAII bears surged to 60.6% last week, the highest since the trough of the 2022 bear market (chart). The AAII bull/bear ratio plunged to 0.32, also as pessimistic as at the trough of the 2022 bear market. We view this widespread pessimism as bullish from a contrarian perspective.

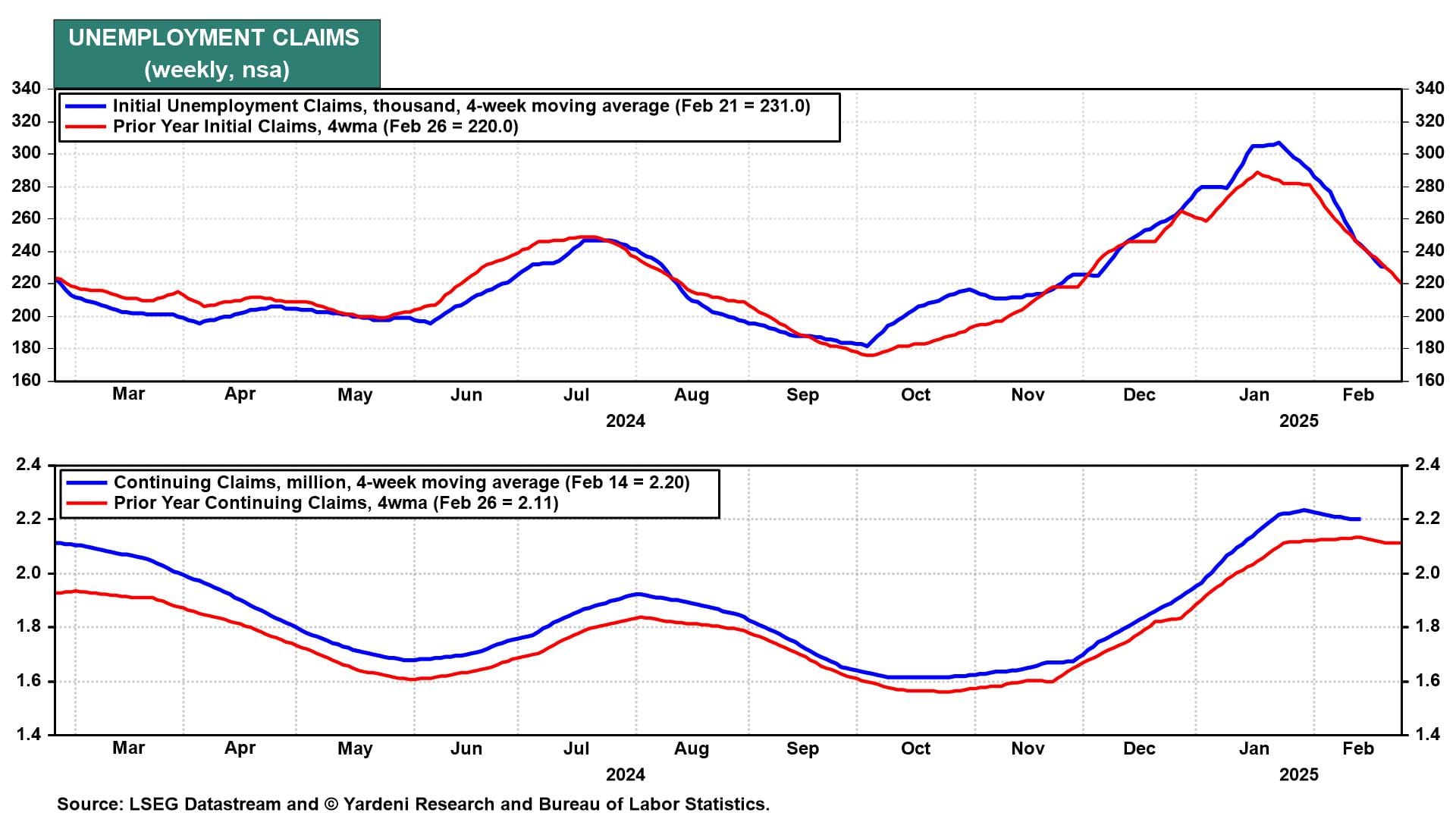

Today's selloff was fueled by the initial unemployment claims report showing a 23,000 increase to 242,000 last week. But perhaps the Presidents’ Day holiday affected the seasonal adjustment. We note that on a not-seasonally-adjusted basis, claims actually fell 3,000 (chart). Then again, the efforts of the DOGE Boys to reduce the size of the federal government may be starting to show up in claims.

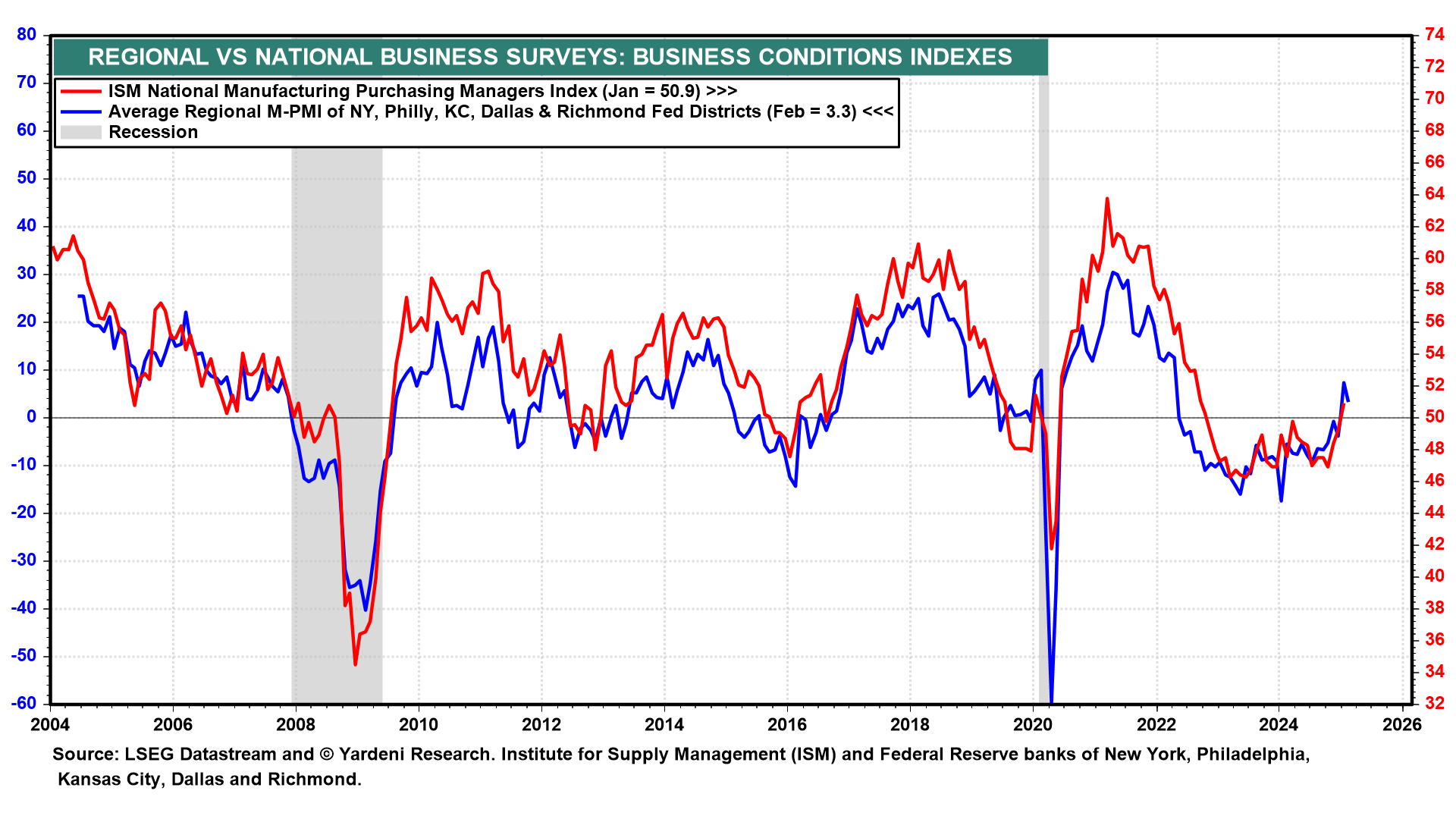

Here's some good economic news: With five of the regional Fed M-PMIs now in hand, there's a high likelihood that February's national ISM M-PMI remained above 50.0 for the second straight month (chart). It will be reported on Monday.

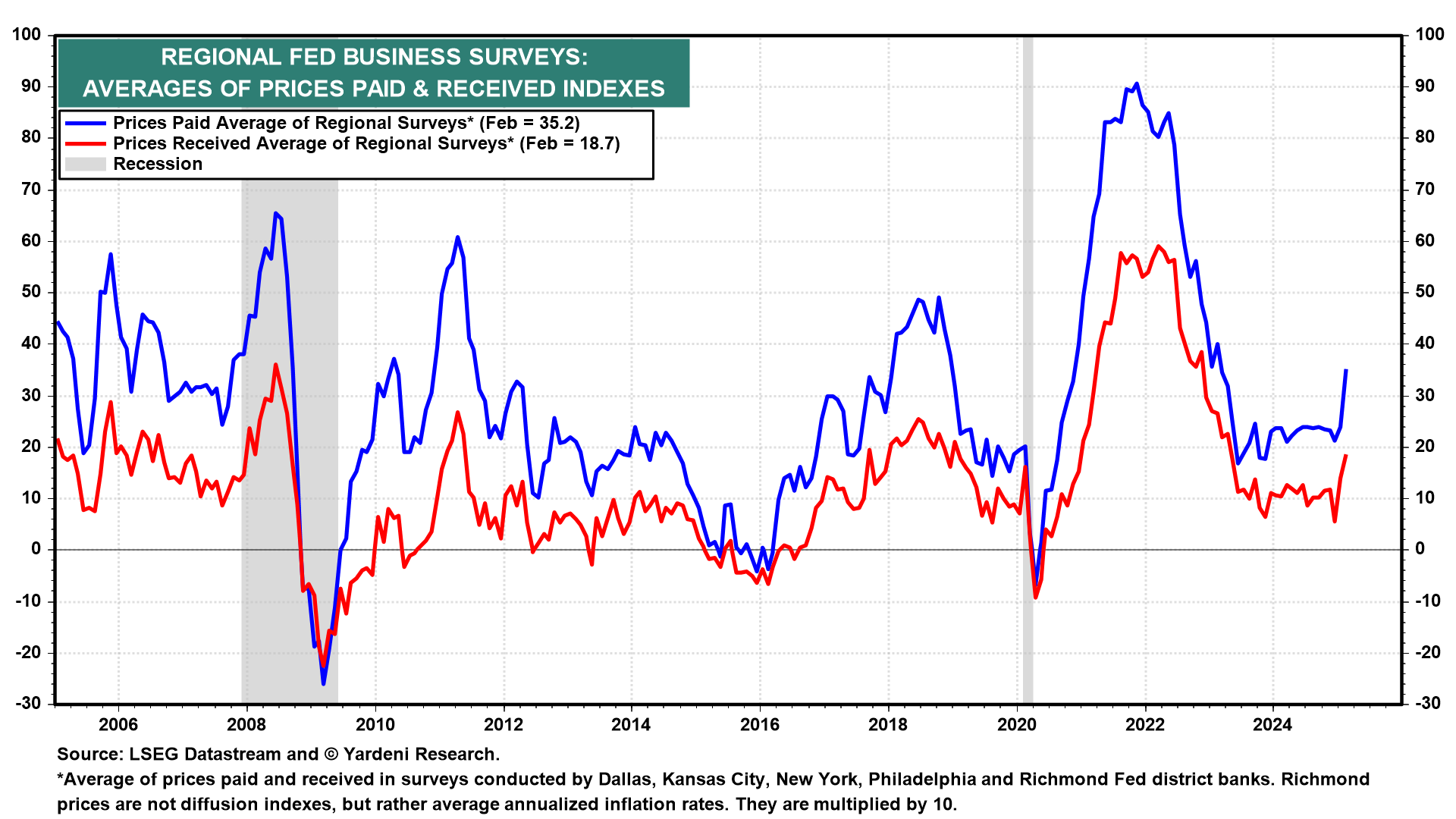

The front running of tariffs has also pushed up price measures across the five US regional surveys (chart). However, we are not convinced that Trump's tariffs will lead to a persistent rebound in headline inflation. Still, they do increase the odds that the Fed will remain on pause, refraining from any further rate cuts this year.