Google-parent Alphabet’s stock sank 7% after the closing bell today following its Q1 earnings report. That was partly because the company announced much higher 2025 capital expenditures than analysts anticipated. After spending $14.28 billion on CapEx in Q4-2024 (above the consensus estimate of $13.26 billion), Alphabet will spend $75 billion on CapEx during 2025, said CEO Sundar Pichai, mostly on building out its AI-related businesses. That's 29% more than the $59 billion expected by analysts. The company is clearly signaling that it disputes claims by Chinese AI lab DeepSeek that its AI is much cheaper and performs just as well as comparable US software programs. Microsoft is still aiming to spend $80 billion on AI infrastructure this year.

The initial reaction to Alphabet's earnings is similar to investors' flinch on the DeepSeek news just last week. Many have become skeptical that the returns on AI will justify big tech companies' massive outlays.

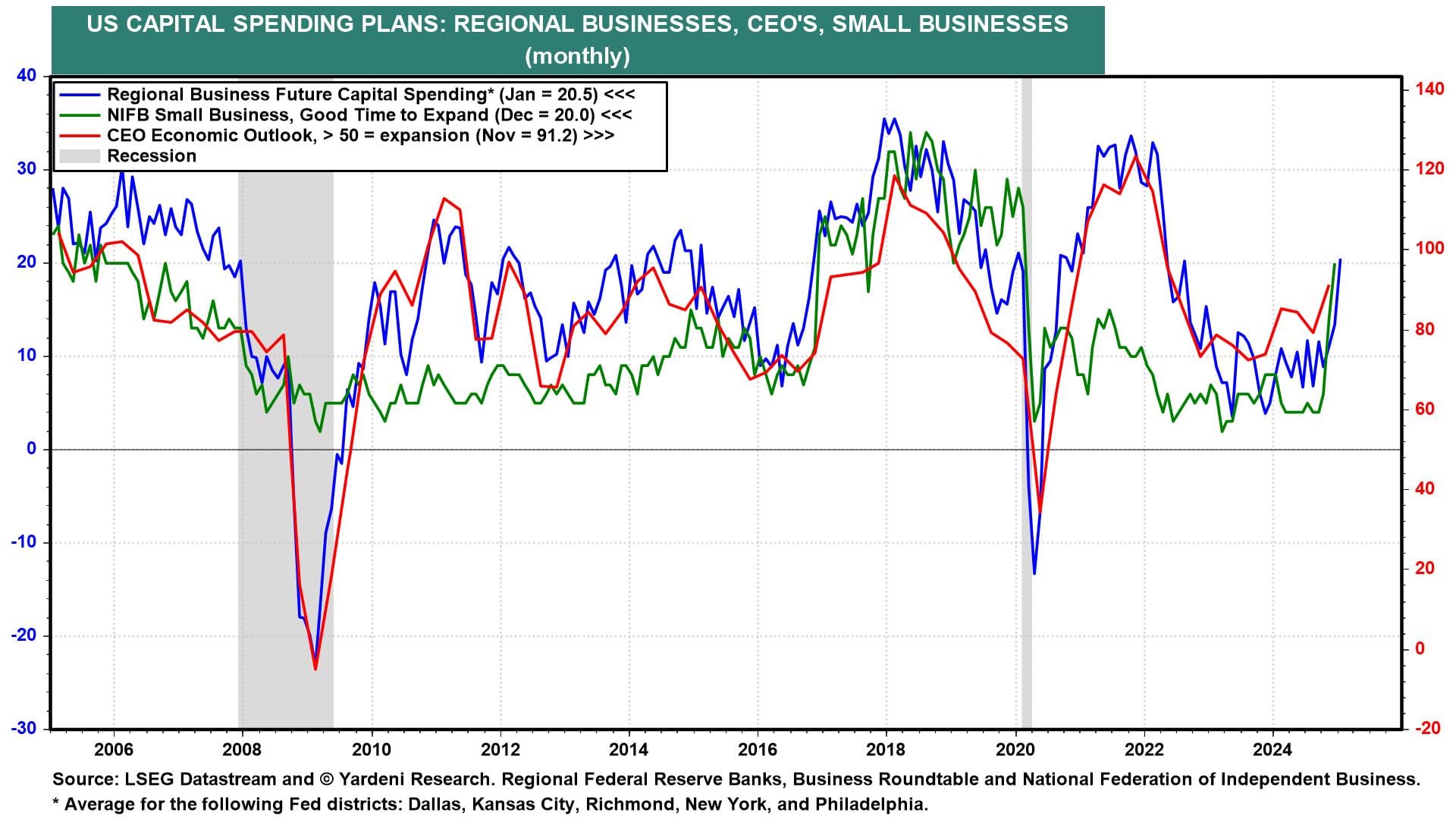

In any event, since the presidential election, small, medium, and large US enterprises alike have been saying they plan to expand their capacity sharply (chart). We expect they will also boost both productivity and employment. Animal spirits are back.

Today's economic data suggest the labor market is finding a balance at full employment, which supports our optimism around economic growth. Here's more: