The US is a tranquil island in a sea of troubles. Geopolitical turmoil poses a threat to the continued prosperity of the US. Like Hamlet, American foreign policymakers need to answer the following question: "Whether 'tis nobler in the mind to suffer the slings and arrows of outrageous fortune, or to take arms against a sea of troubles, and by opposing end them?"

In the US, the economy continues to grow at a solid pace and the risks of a recession have declined significantly now that the Fed is lowering interest rates to boost economic growth. A few Fed officials--including regional Fed presidents Raphael Bostic, Austan Goolsbee, and Neel Kashkari--were out on the media circuit today. Their message to markets was that more interest rate cuts are coming soon. The Fed has effectively taken any recession risks off the table as evidenced by the narrow spread between the composite yield of high-yield corporate bonds and the 10-year Treasury bond (chart).

Nevertheless, we continue to monitor the risks to our happy Roaring 2020s base-case scenario:

(1) Inflation risk. US flash PMIs released by S&P Global today showed the services-providing sector continued to expand in September (55.4) while the goods-producing sector remained weak (47.0). Lower interest rates should boost the latter. Meanwhile, prices charged for goods and services rose at the fastest pace in six months. Input costs for services companies grew at a 12-month high due to rising wages.

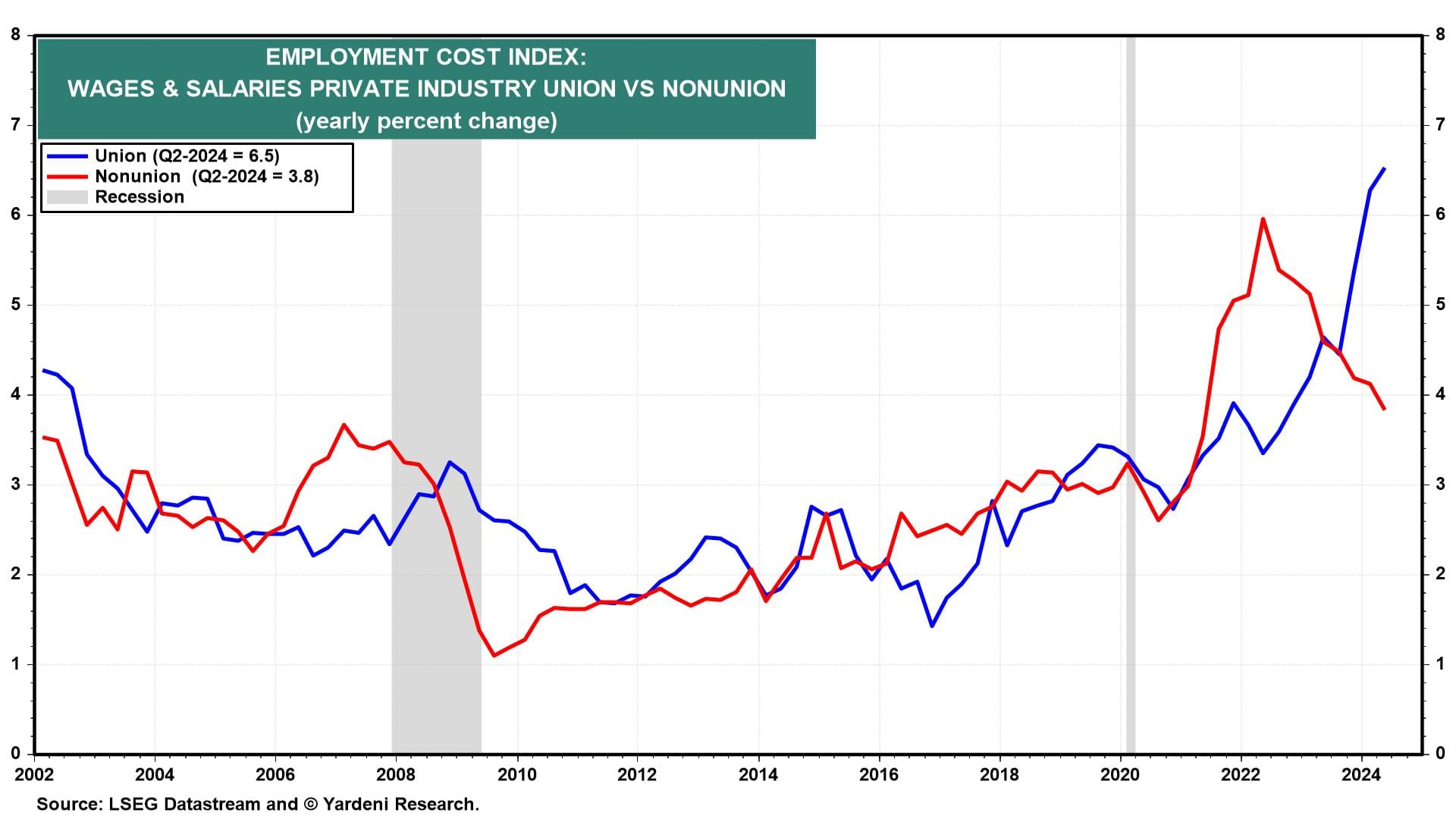

Anecdotally, Boeing offered a 30% general wage increase over four years to thousands of striking workers today, Reuters reported. It also offered a performance bonus, ratification bonus, and improved retirement benefits. Union wages rose at a brisk pace of 6.5% y/y in Q2 (chart).