I. US FINANCIAL MARKETS

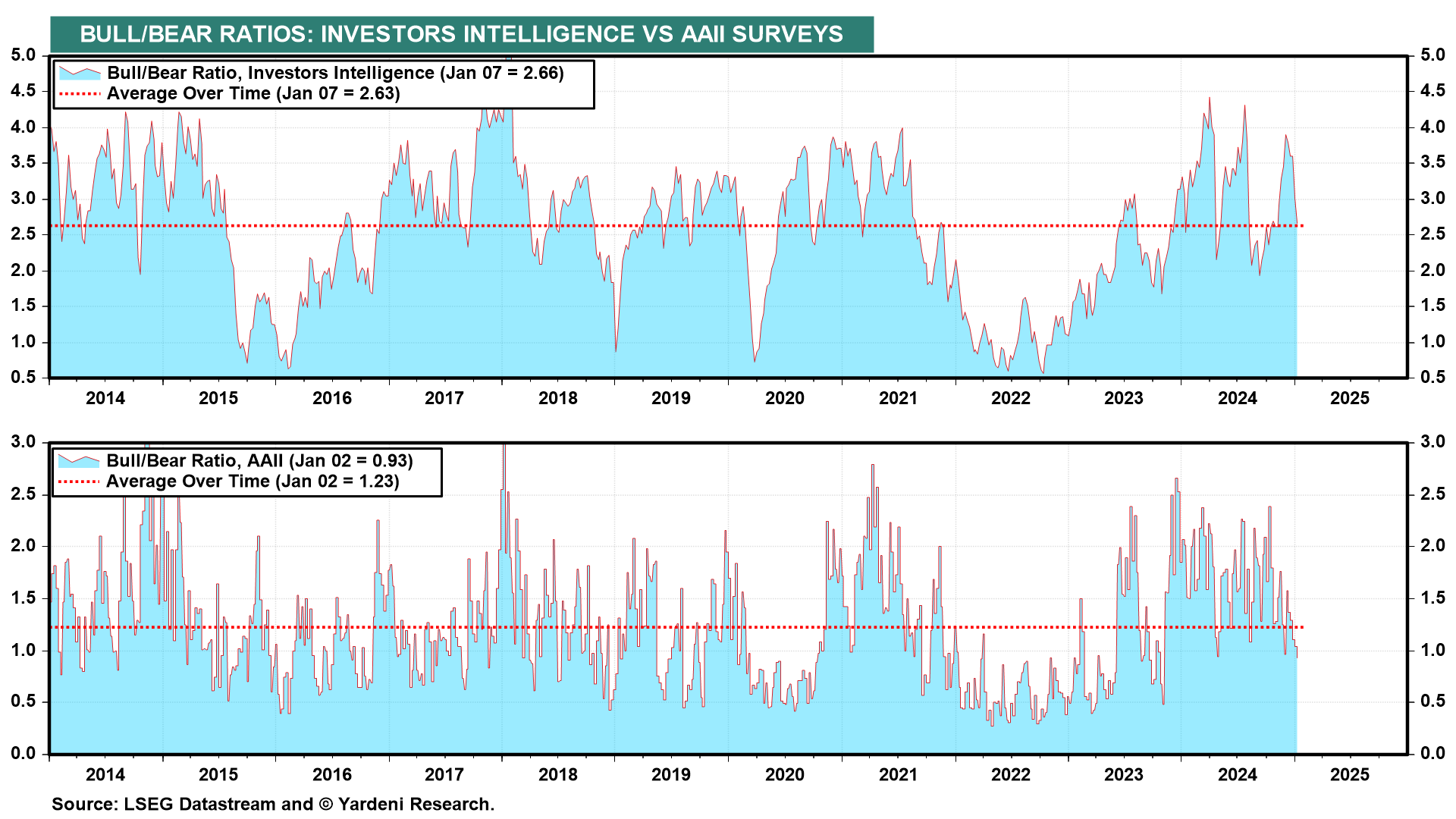

The bull/bear ratios have dropped sharply over the past couple of weeks (chart). From a contrarian perspective that's a bullish development for the US stock market.

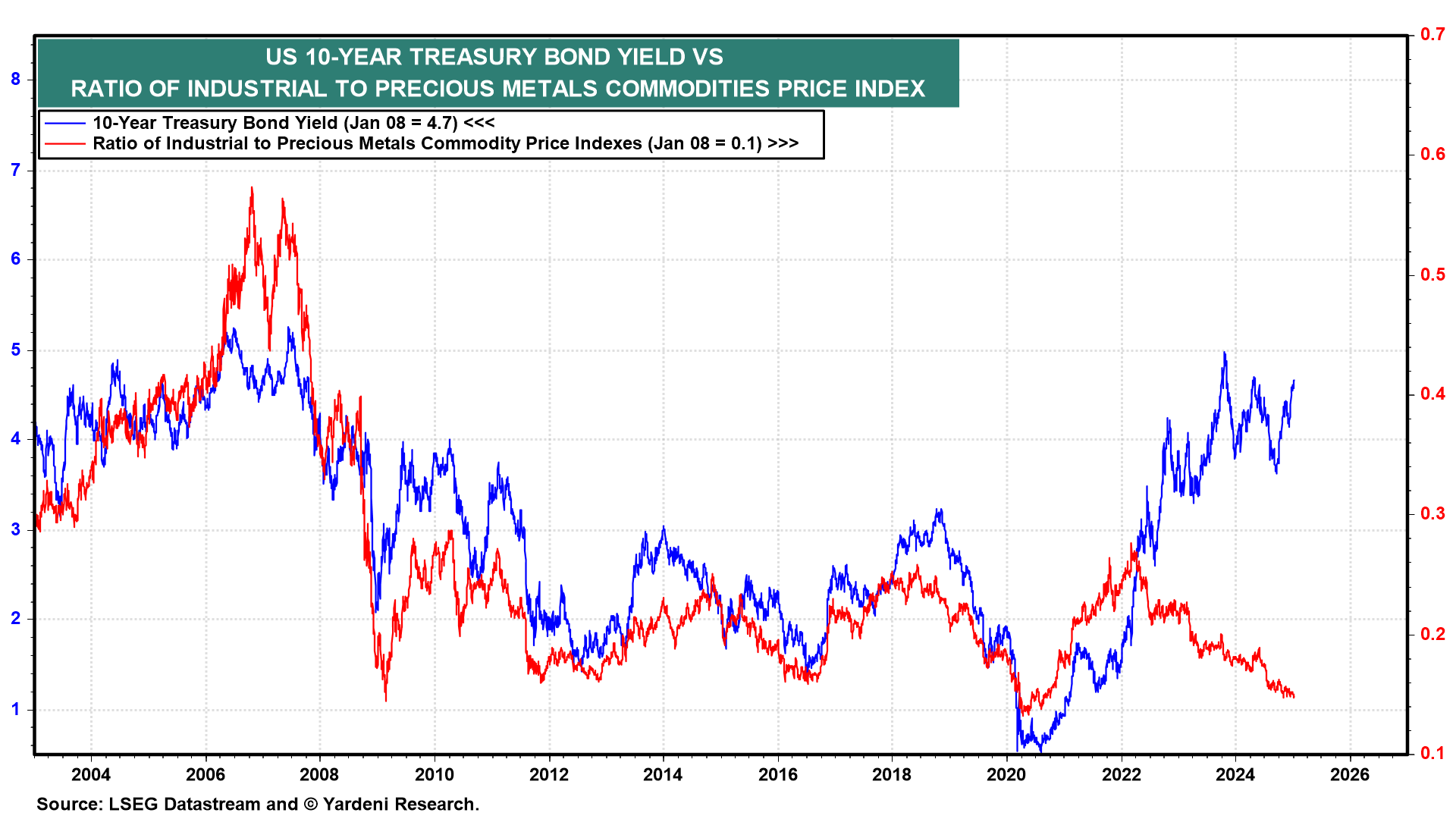

The US bond yield has been increasing while the ratio of industrial to precious metals commodity prices has been falling since 2022 (chart). This unusual divergence might suggest that bond investors are increasingly concerned about the long-term inflationary consequences of mounting US federal budget deficits, while China's weak economy is depressing industrial commodity prices relative to precious metals prices. China is buying less copper, but the Peoples Bank of China is buying more gold.

II: US ECONOMY

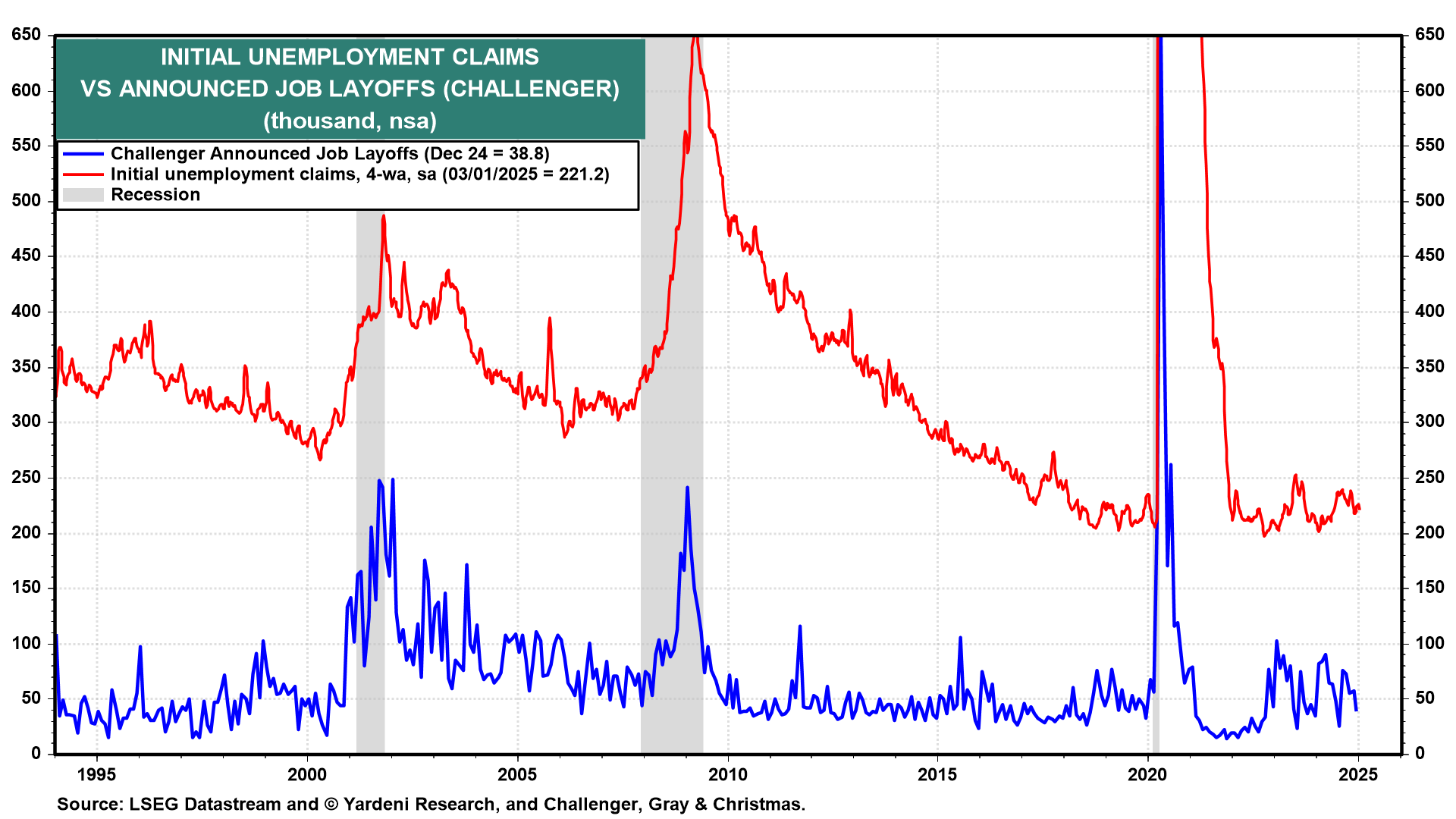

The US labor market remains robust as evidenced by the recent low readings in initial unemployment claims (chart). In addition, the Challenger series on layoff announcements remains low.

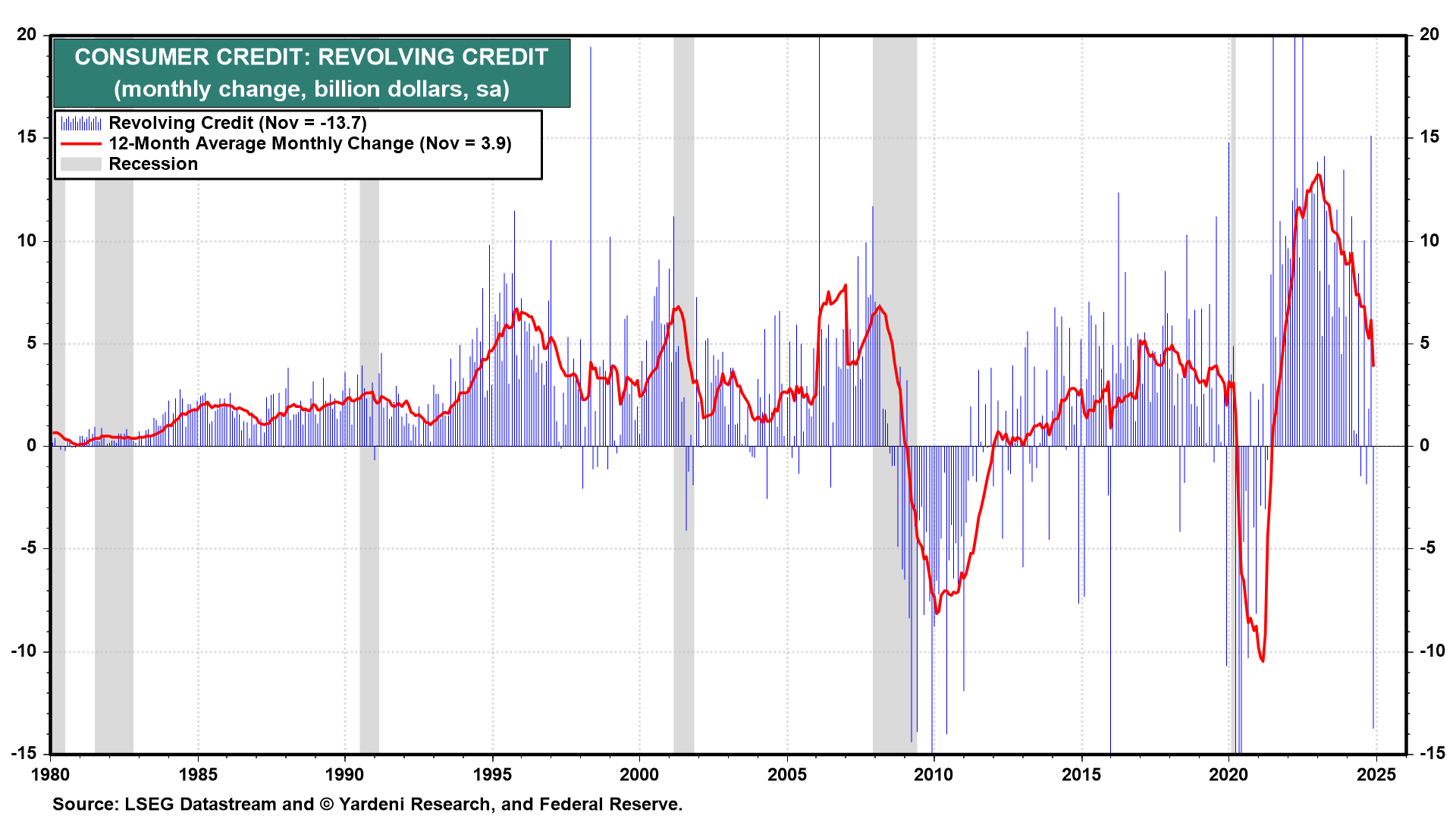

We attribute the sharp drop in consumer revolving credit during November to statistical volatility (chart). Other measures of consumer confidence and spending suggest that the holiday selling season was strong.

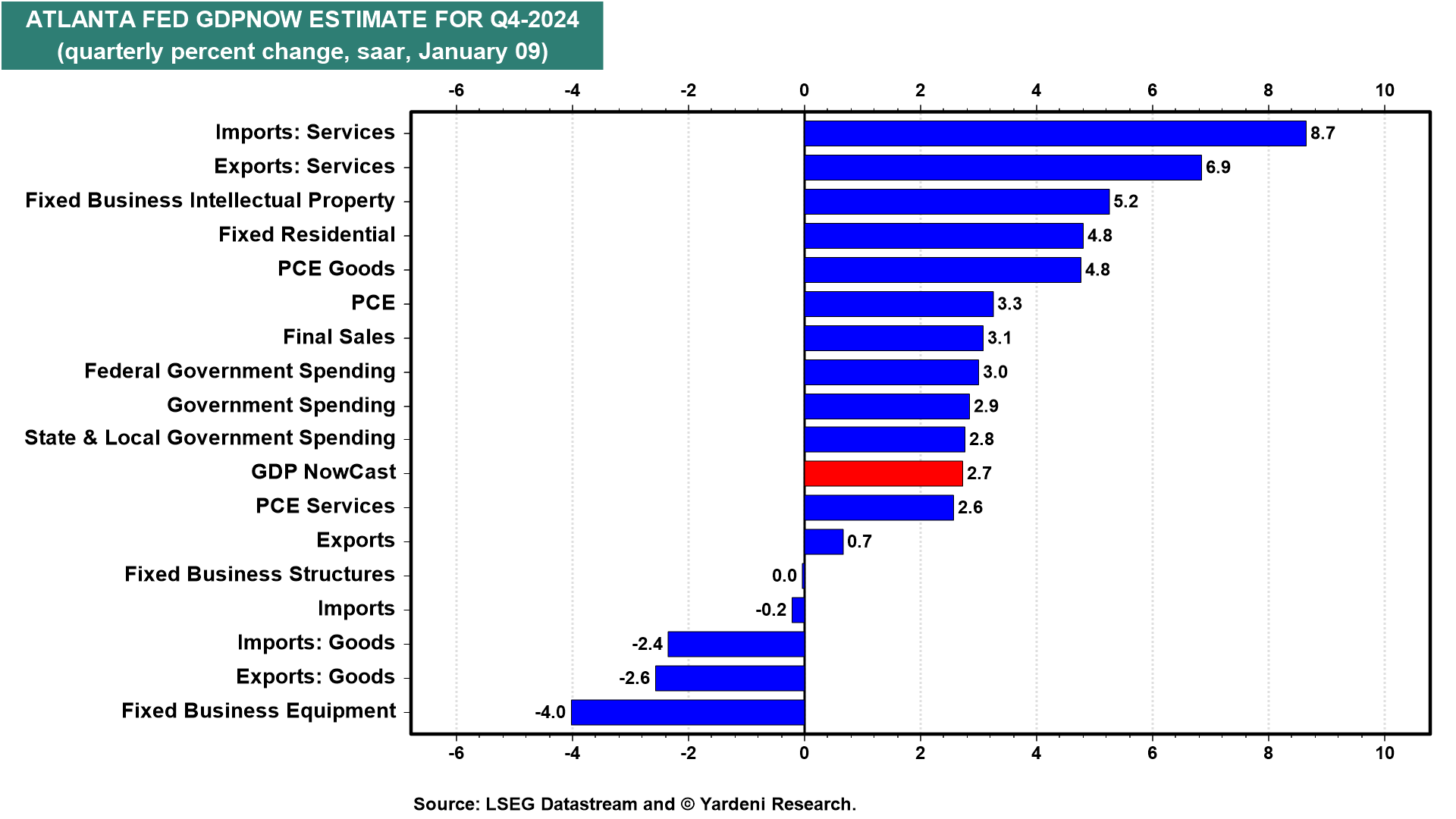

The Atlanta Fed's GDPNow tracking model is showing that real GDP rose 2.7% (saar) during Q4 (chart). The growth rates of real GDP of goods and services are tracking at 4.8% and 2.6%. Those are all solid numbers.

III. GLOBAL ECONOMY

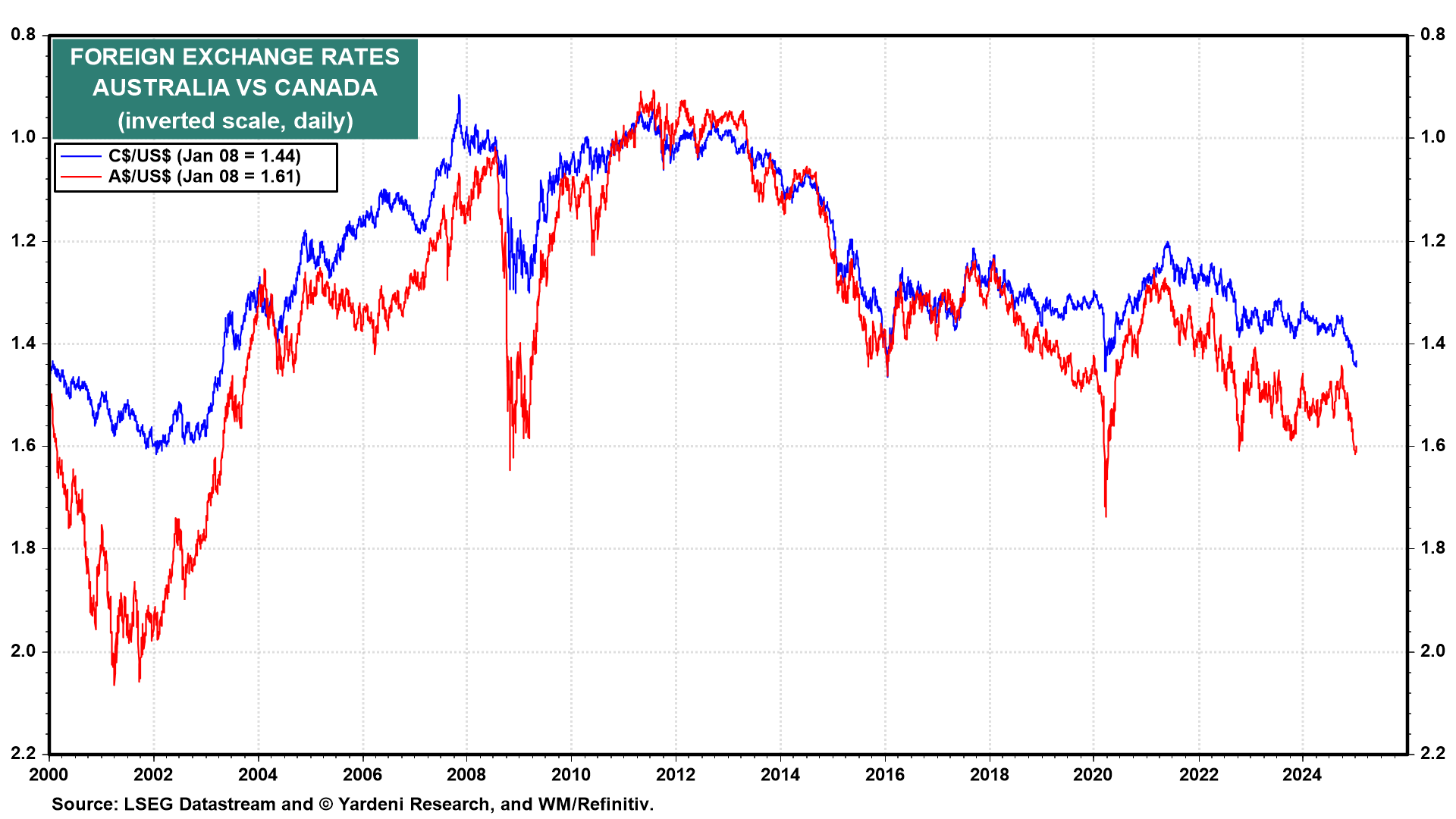

The dollar continues to strength as other currencies continue to weaken. The currencies of commodity-exporting countries have been weak because commodity prices have remained subdued because the economies of China and Europe are anemic (chart).

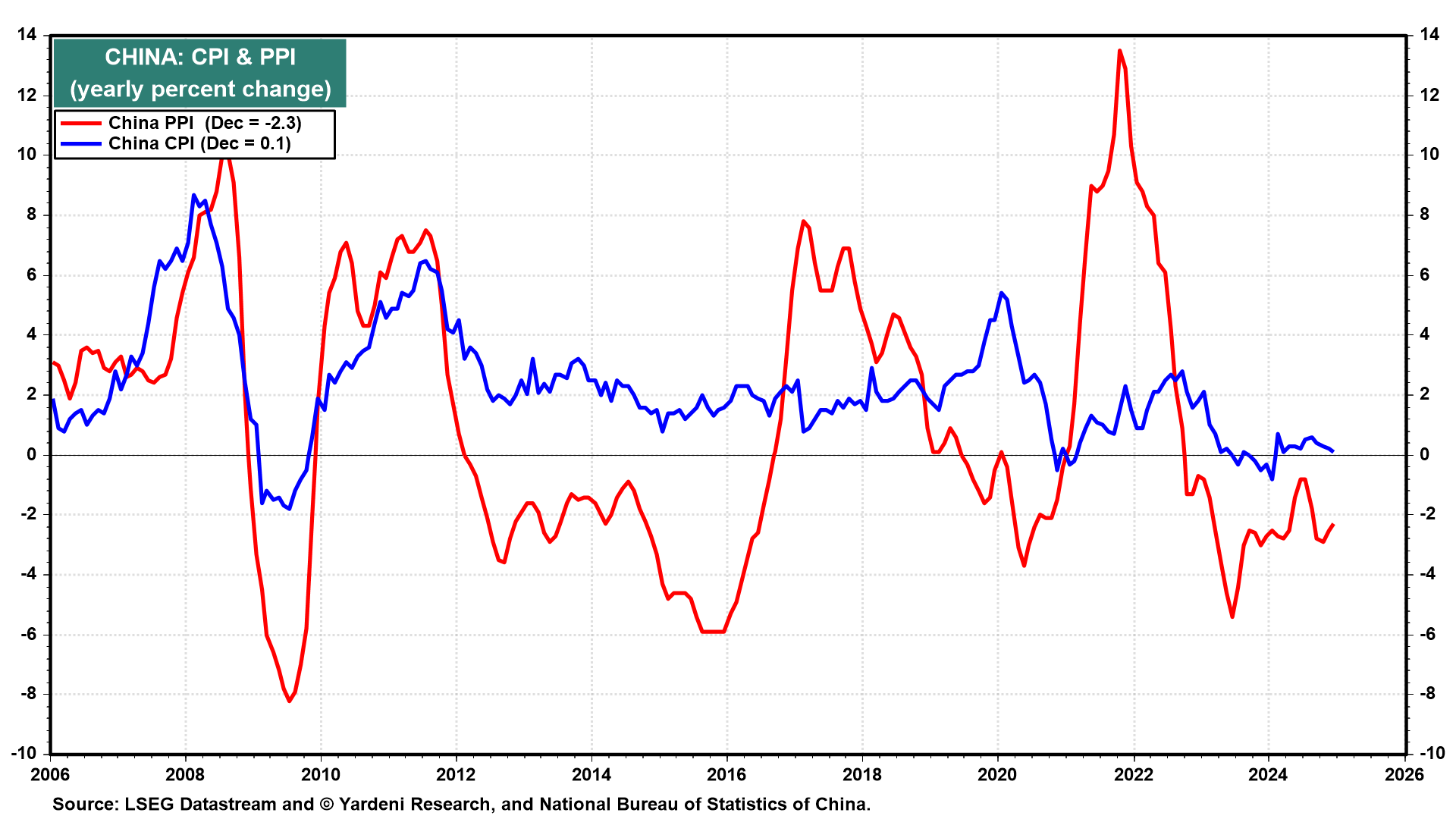

In December, China's PPI inflation rate remained negative, while the country's CPI inflation rate was close to zero (chart). These numbers reflect the weakness of China's economy.

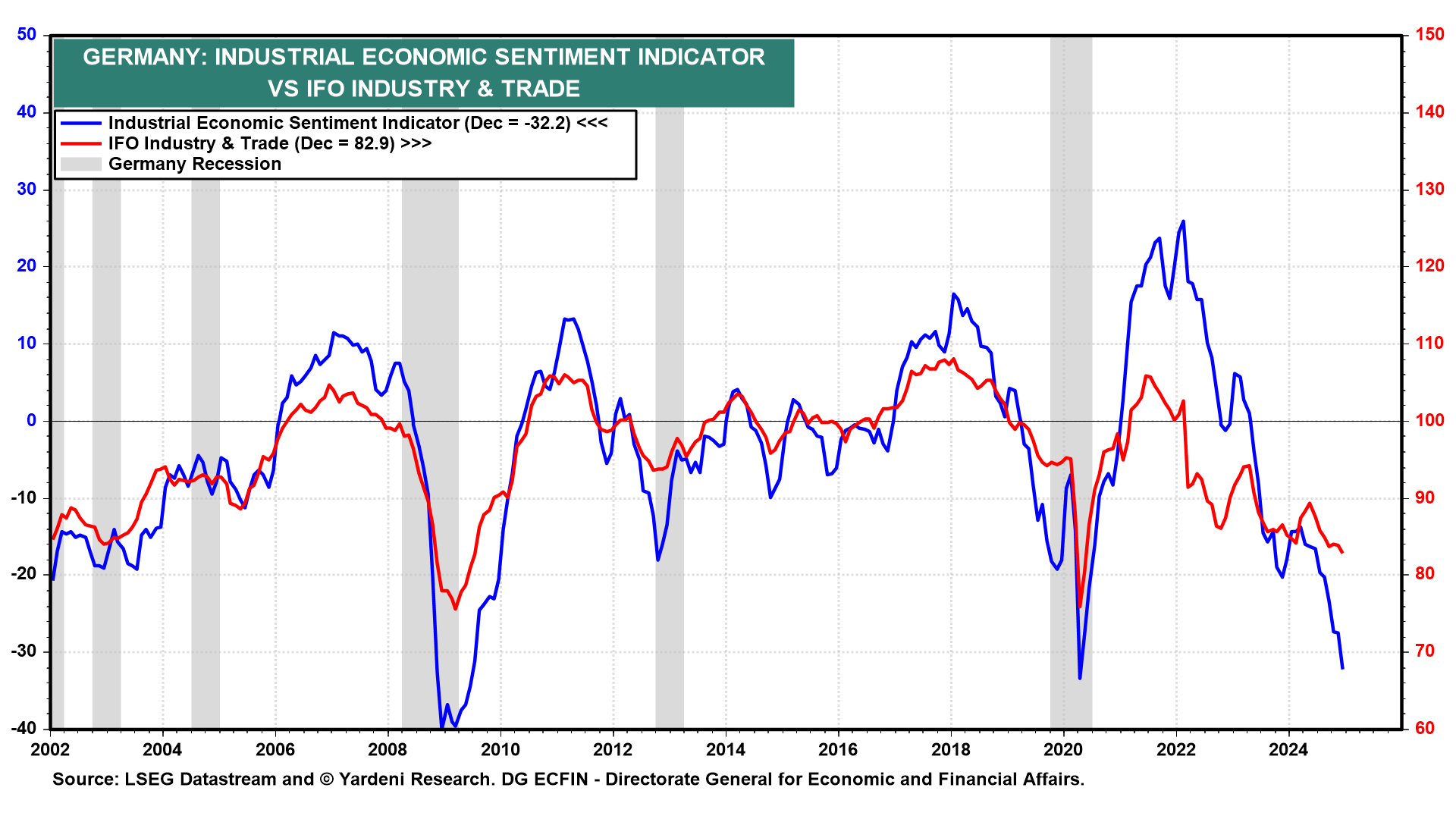

Germany's faltering economy is weighing on the European regional economy. The Economic Sentiment Indicator (ESI) fell during December in both. Germany's industrial ESI as well as the IFO industry & trade index are signaling a recession in the manufacturing sector (chart).