We've been asked to comment on yesterday's grim forecast by economists at Goldman Sachs that the S&P 500 will produce annualized returns of only 3% (before accounting for inflation) over the next 10 years. They reckon that the range of possible outcomes includes -1% at the low end and +7% nominal returns at the high end.

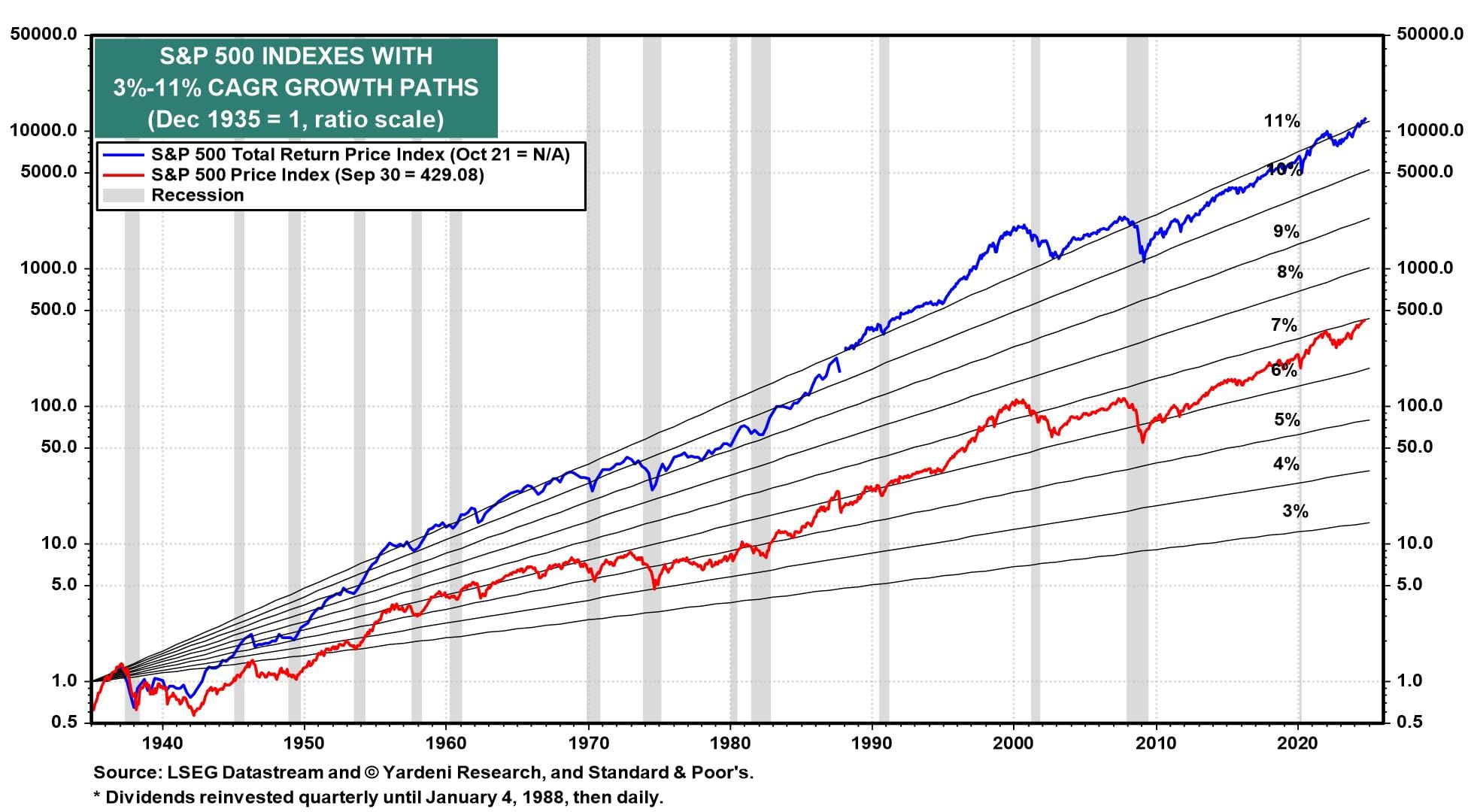

In our opinion, even Goldman's optimistic scenario might not be optimistic enough. That's because we believe that the US economy is in a "Roaring 2020s" productivity growth boom with real GDP currently rising 3.0% y/y and inflation moderating to 2.0%. If the productivity growth boom continues through the end of the decade and into the 2030s, as we expect, the S&P 500's average annual return should at least match the 6%-7% achieved since the early 1990s (chart). It should be more like 11% including reinvested dividends.

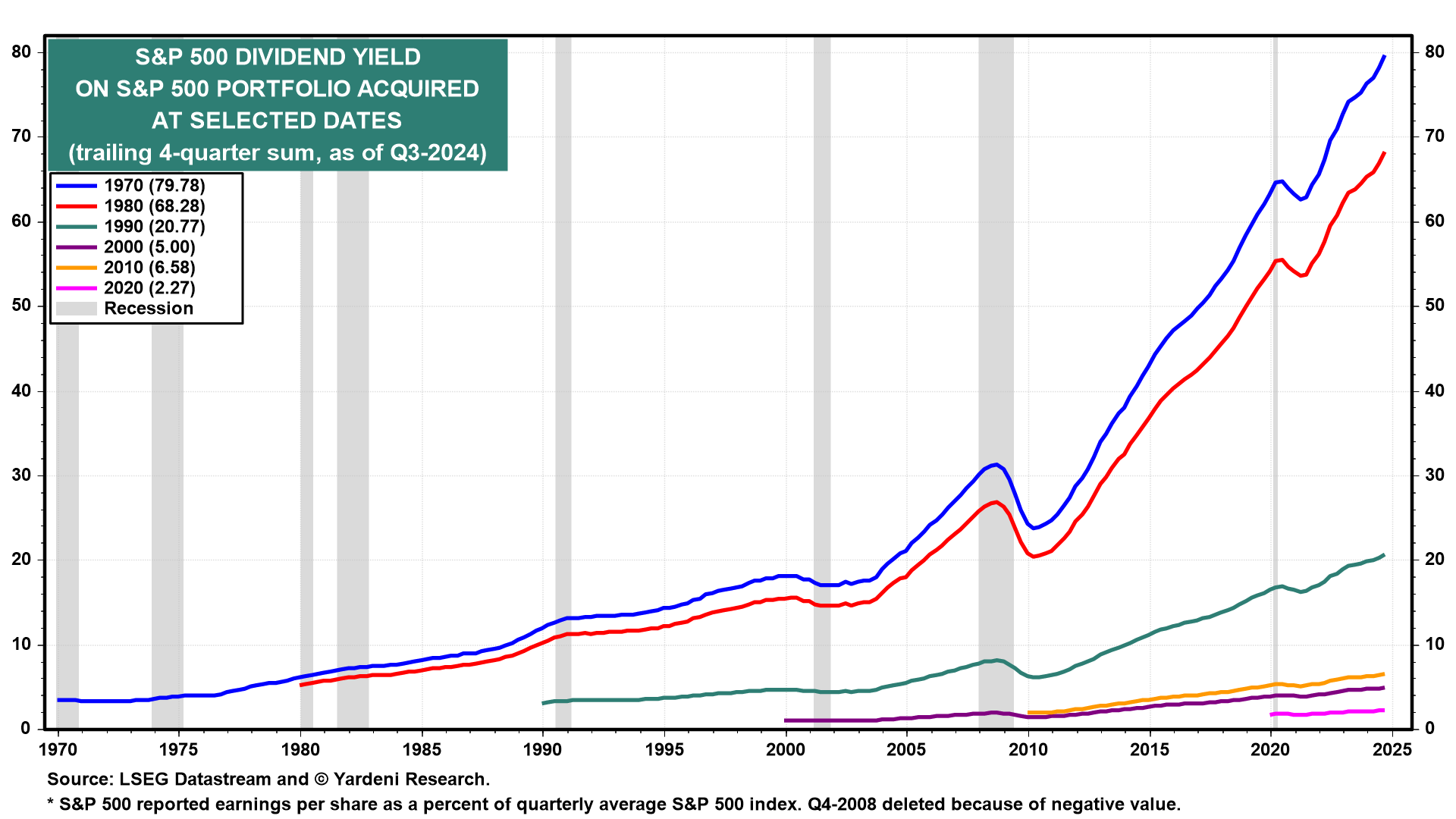

It's hard to imagine that the total return of the S&P 500 would be only 3% in the future given the returns just from the compounding of reinvested dividends (chart).

Let's dig into some of the points made by Goldman:

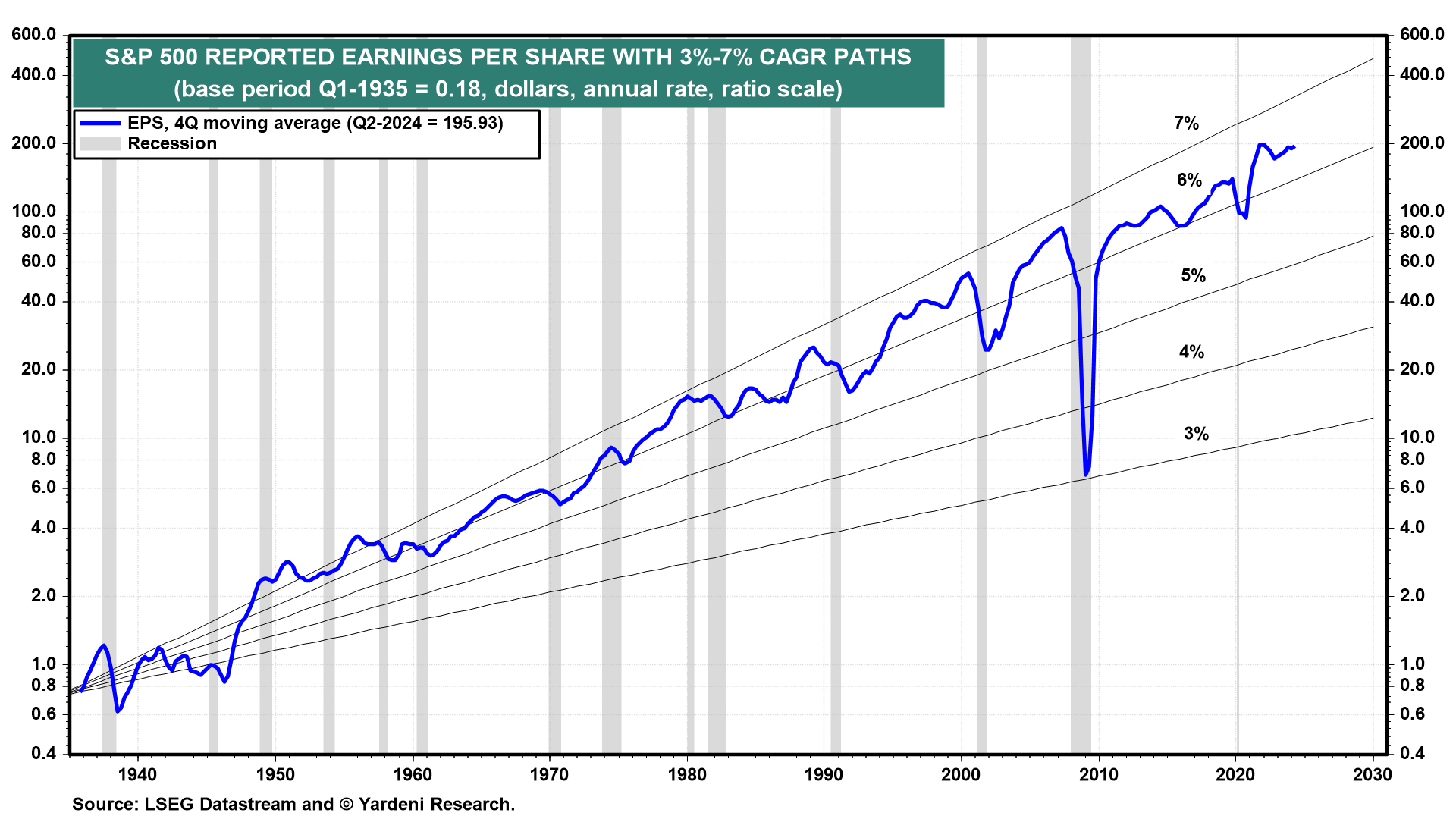

(1) Earnings growth. S&P 500 earnings per share has grown roughly 6.5% per year for nearly a century (chart). Assuming 6% growth over the coming decade (and removing dividends from the equation), valuations would need to be cut in half to produce just 3% annual returns.

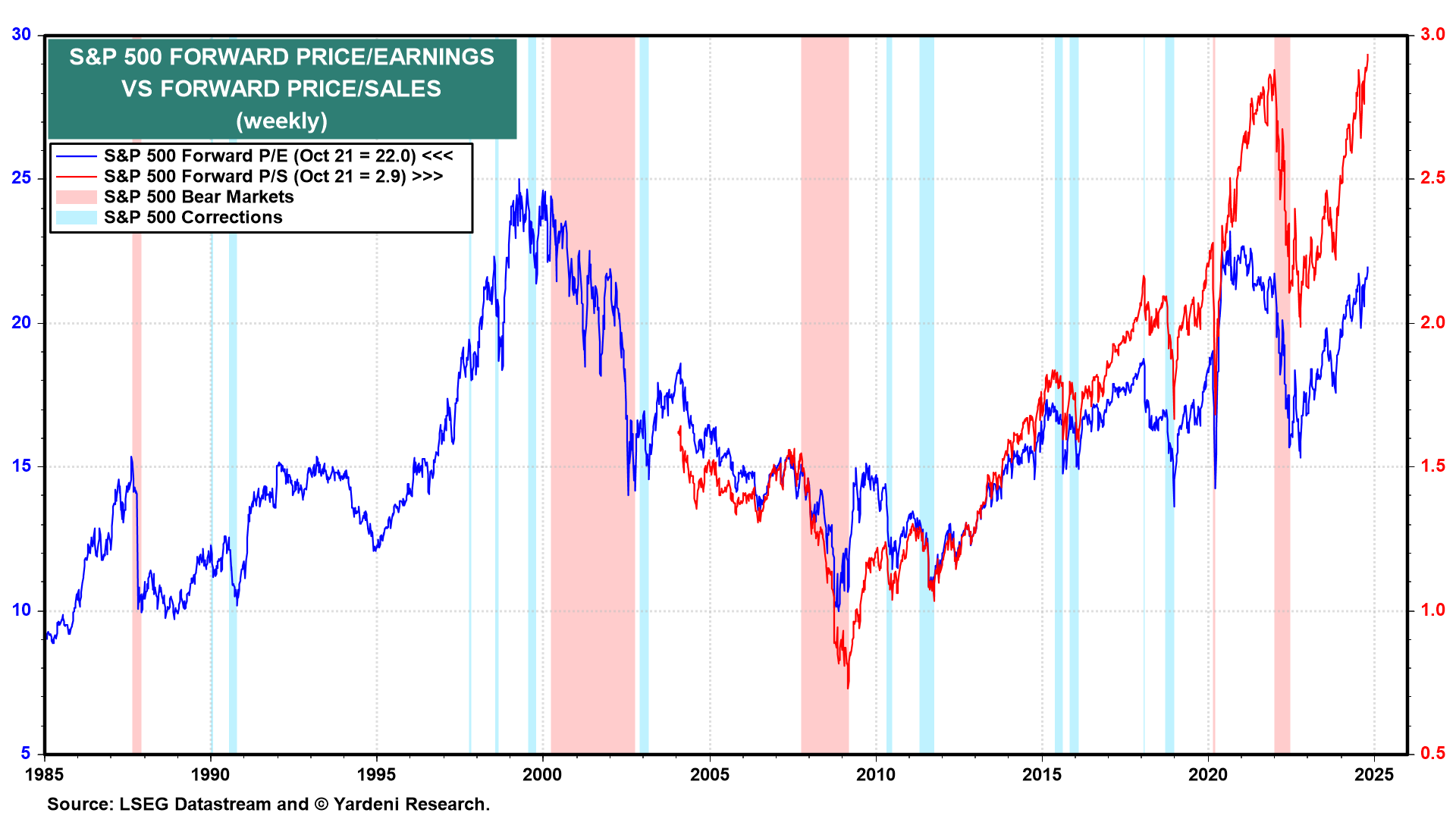

(2) Valuation. Much of Goldman's analysis is a story of high valuations. Conventional wisdom holds that higher starting valuations lead to lower future returns. With the Buffett Ratio (i.e., forward P/S) at a record high 2.9, and the S&P 500 forward P/E elevated at 22.0 times, we agree that valuations are stretched by historical standards (chart).

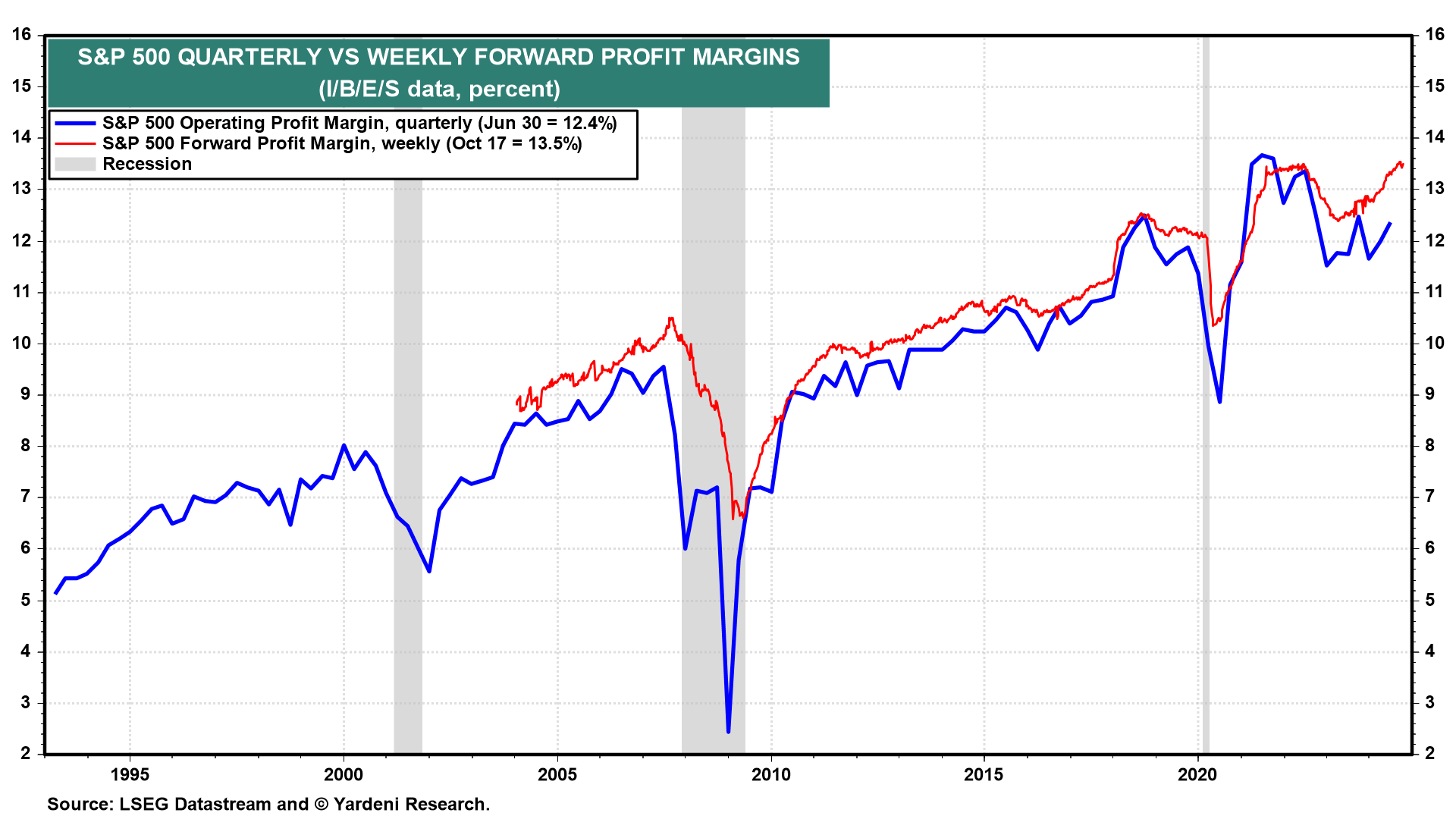

(3) Profit margin. The forward P/E is relatively low compared to the forward P/S because the S&P 500 forward profit margin has been rising into record high territory and should continue to do so in our Roaring 2020s scenario (chart).

(4) Inflation hedge. Goldman's forecast does not consider that stocks are historically the best inflation hedge, as companies have embedded pricing power. Meanwhile, bonds suffer as interest rates rise to combat higher inflation.

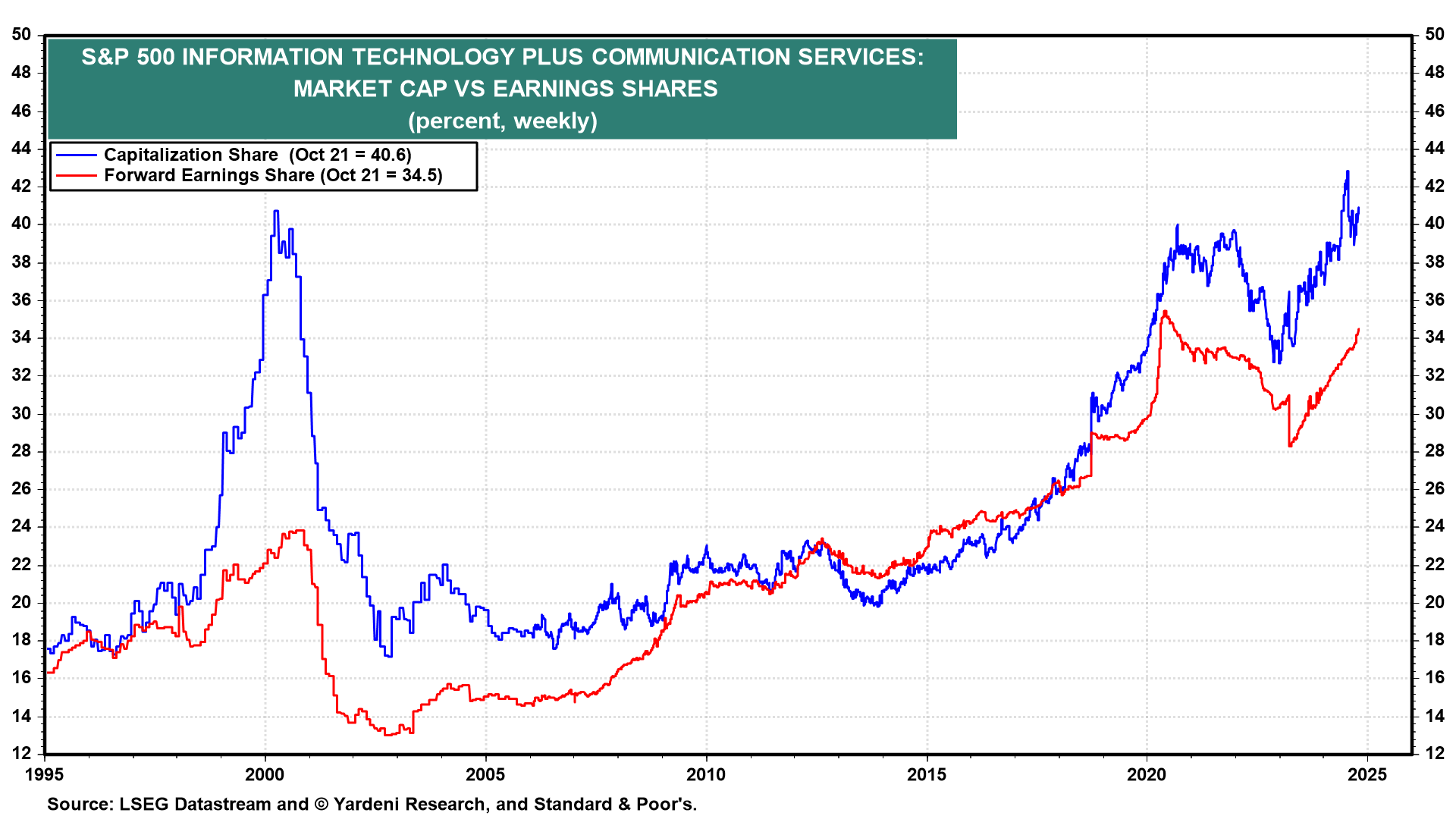

(5) Market concentration. One of the biggest "worries" in Goldman's analysis is that the market is highly concentrated. But while the Information Technology and Communication Services sectors are now about 40% of the overall S&P 500, around the same as the peak of the dotcom bubble, these are much more fundamentally sound companies.

These two sectors account for more than a third of the S&P 500's forward earnings today versus less than a quarter in 2000 (chart). We also believe that all companies can be thought of as technology companies. Technology isn't just a sector in the stock market, but an increasingly important source of higher productivity growth, lower unit labor costs inflation, and higher profit margins for all companies.

(6) Bottom line. In our view, a looming lost decade for US stocks is unlikely if earnings and dividends continue to grow at solid paces boosted by higher profit margins thanks to better technology-led productivity growth. The Roaring 2020s might lead to the Roaring 2030s.