One of our competitors claims that we are in a recession. Another claims that we will soon be in a recession. The most widely anticipated recession of all times is turning into the longest widely anticipated recession of all times. One day, the diehard hard-landers will be right. Was today the day? We're sure that their heartbeats quickened on today's jobless claims report. Consider the following:

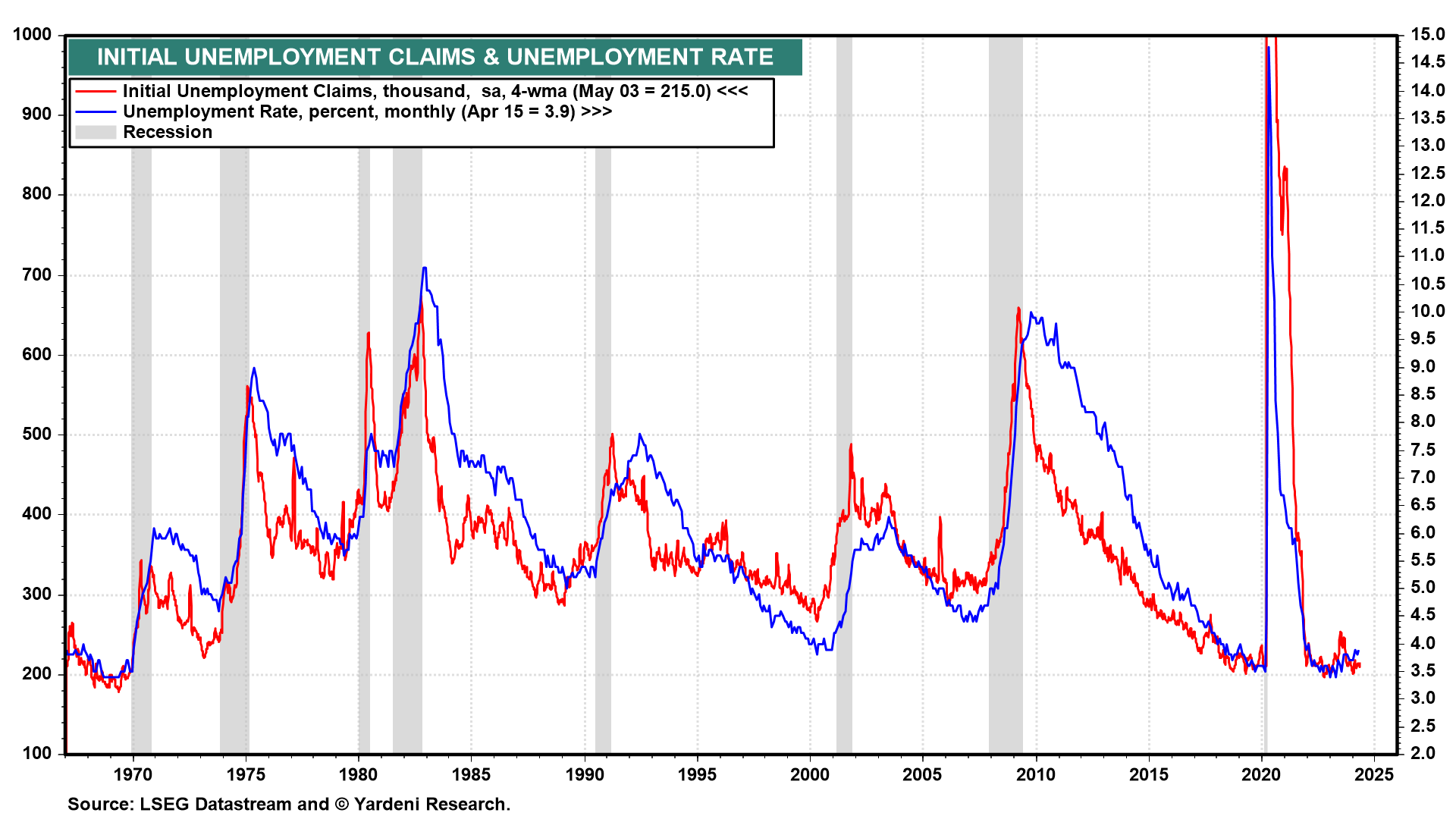

(1) Initial unemployment claims hit their highest level since August during the May 4 week. They rose 22,000 to 231,000 (sa [seasonally adjusted]), one of its first meaningful increases after a string of low readings. Recall, jobless claims are often a good leading indicator for where the economy is heading—managers don't reduce their payrolls when they're looking to expand their business. This comes on the heels of April's nonfarm payrolls print, which showed the smallest employment gain since October. Furthermore, the unemployment rate ticked higher last month to 3.9% (chart).

However, the unemployment rate is best correlated with the four-week average of jobless claims, which remained low at 215,000. We won't be surprised if the jobless rate remained below 4.0% in April for the 28th consecutive month. If the latest data signal a recession, then so far it is mostly in New York, which saw an increase of more than 10,000 (nsa [not seasonally adjusted]), accounting for more than half the total gain of 19,690 (nsa).

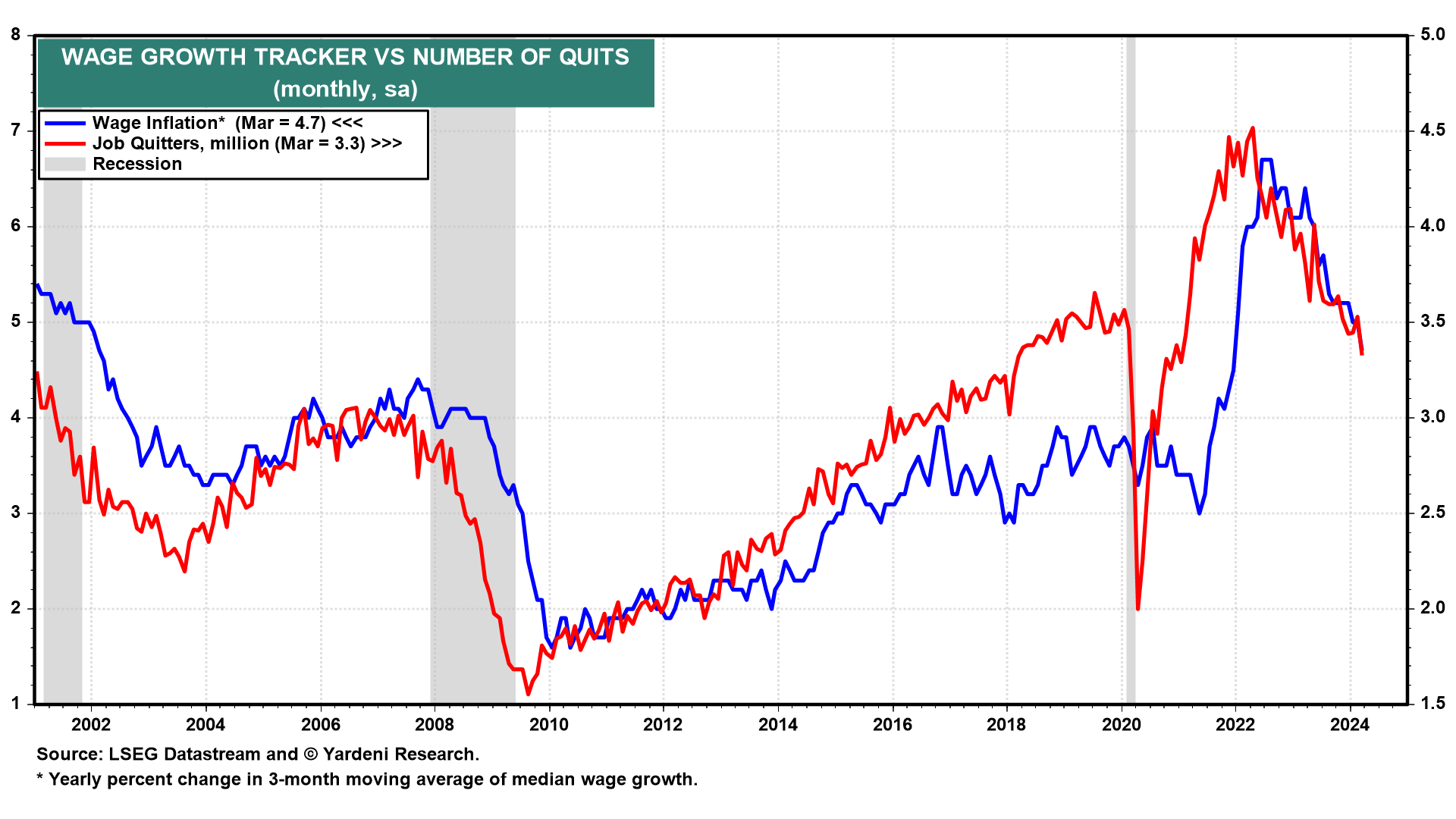

(2) The labor market remains robust, to be sure, but employees who see fewer opportunities might be more hesitant to ask for a raise or quit outright. Indeed, growth in wages is quickly falling from its recent peak, and the number of quits is back down to pre-pandemic levels (chart).

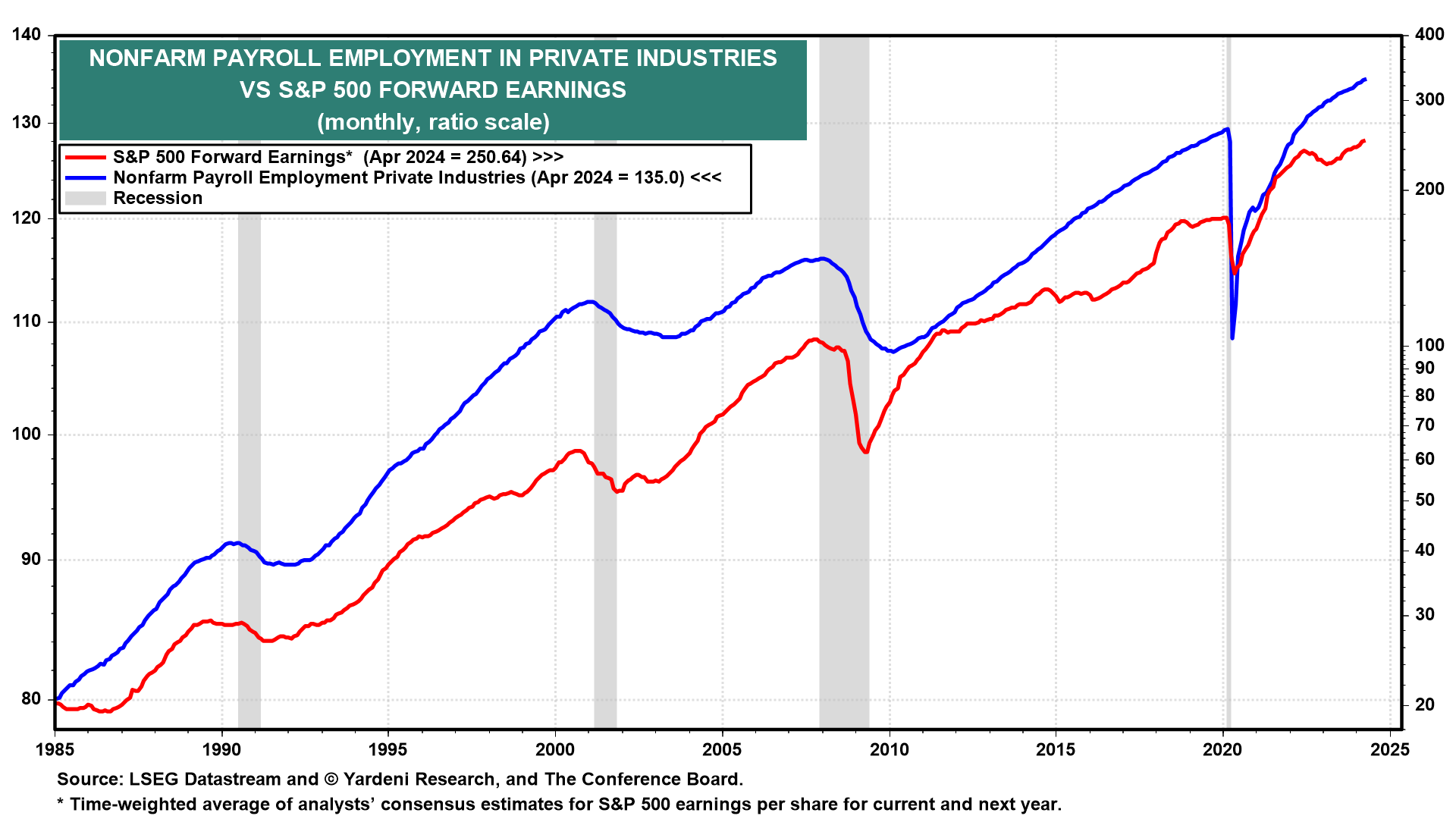

(3) In our opinion, S&P 500 forward earnings per share is an excellent coincident indicator of nonfarm payroll employment in private industry (chart). That makes sense since profitable companies hire, while unprofitable ones fire. Forward earnings rose to a record high during April, consistent with a solid labor market. So we don't buy the claim that the latest jobless claims is just the beginning of a significant downturn in the labor market and the economy.

(4) Nevertheless, we won't be surprised if Fed officials start talking more dovishly. That should give stocks and bonds a boost, especially after their recent hawkishness sent bond yields higher and weighed on equities.