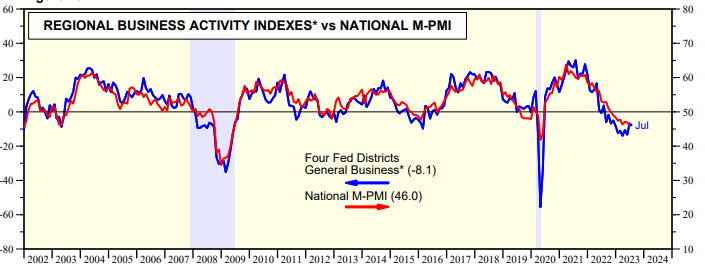

The M-PMI is released on the first business day of each month. The NM-PMI is released two days later. We expect that the former (Tue) will show that the rolling recession in the goods-producing sector is bottoming, while the latter (Thu) should show that the service-providing sector is still expanding. We already have four of the regional business surveys conducted by five FRB district banks. The average of their general business indexes (which tracks the M-PMI ) edged down in July, but remains above its readings earlier this year (chart).

The first week of the month is also a big one for employment indicators. The JOLTS report (Tue) is likely to show that job openings remained plentiful through June as confirmed by the "jobs available" series in the consumer confidence survey through July (chart).