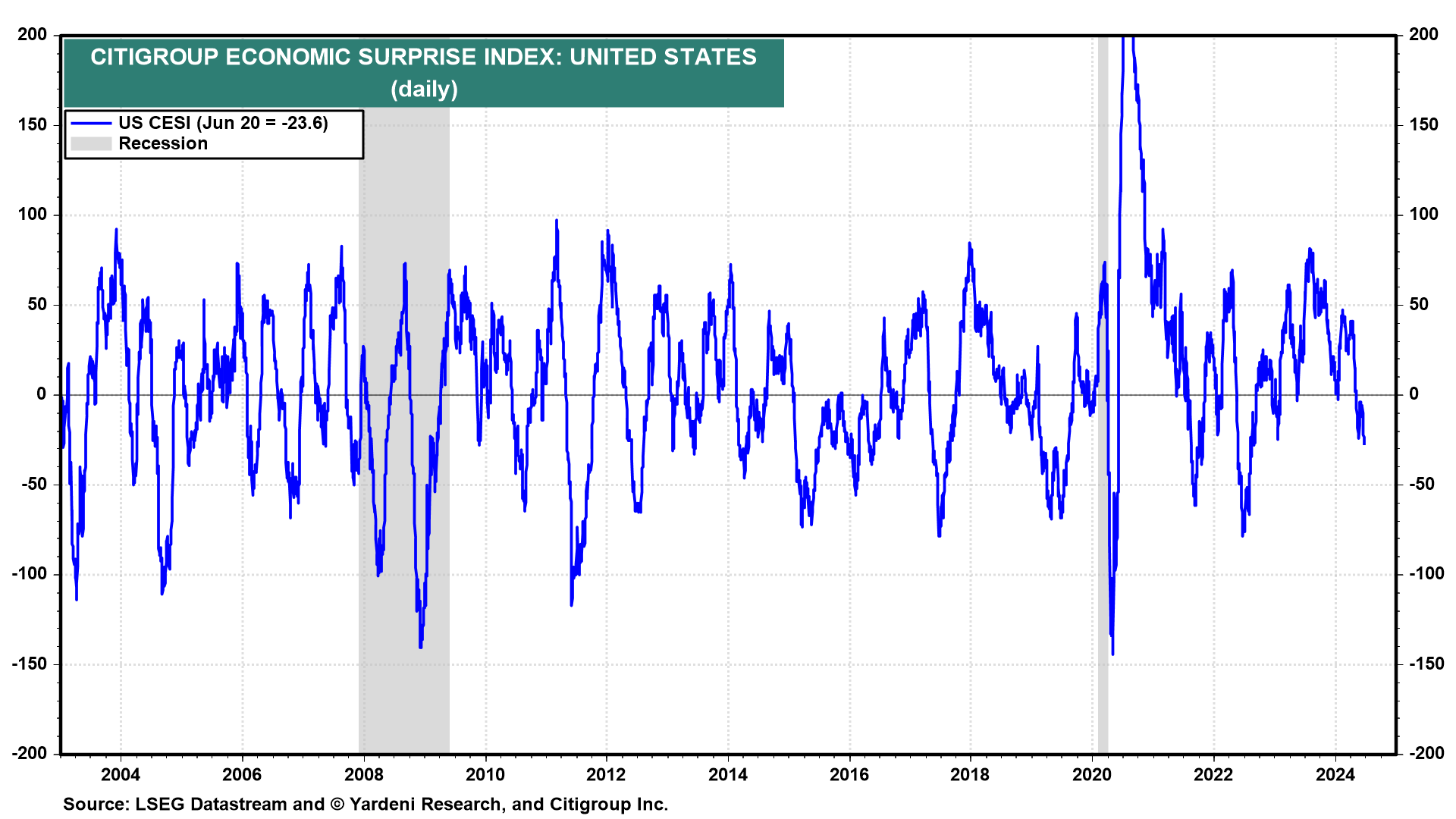

Today's batch of economic indicators was on the weak side. Indeed, the Citigroup Economic Surprise Index fell deeper into negative territory today (chart). Does this suggest that the odds of a recession are increasing? Nope: The Atlanta Fed's GDPNow tracking model is now projecting 3.0% real growth in Q2, down from 3.1% on June 18.

The stock market held its ground: The S&P 500 briefly crossed 5,500 for the first time in its history, before Nvidia's -3.5% breather helped drag the index a bit lower into the close. The 10-year Treasury bond yield remained around 4.25% as investors concluded that the Fed's higher-for-longer interest rate policy remained intact.

Today's batch of economic indicators included housing starts, two regional business surveys for June, and initial unemployment claims. Let's review the data:

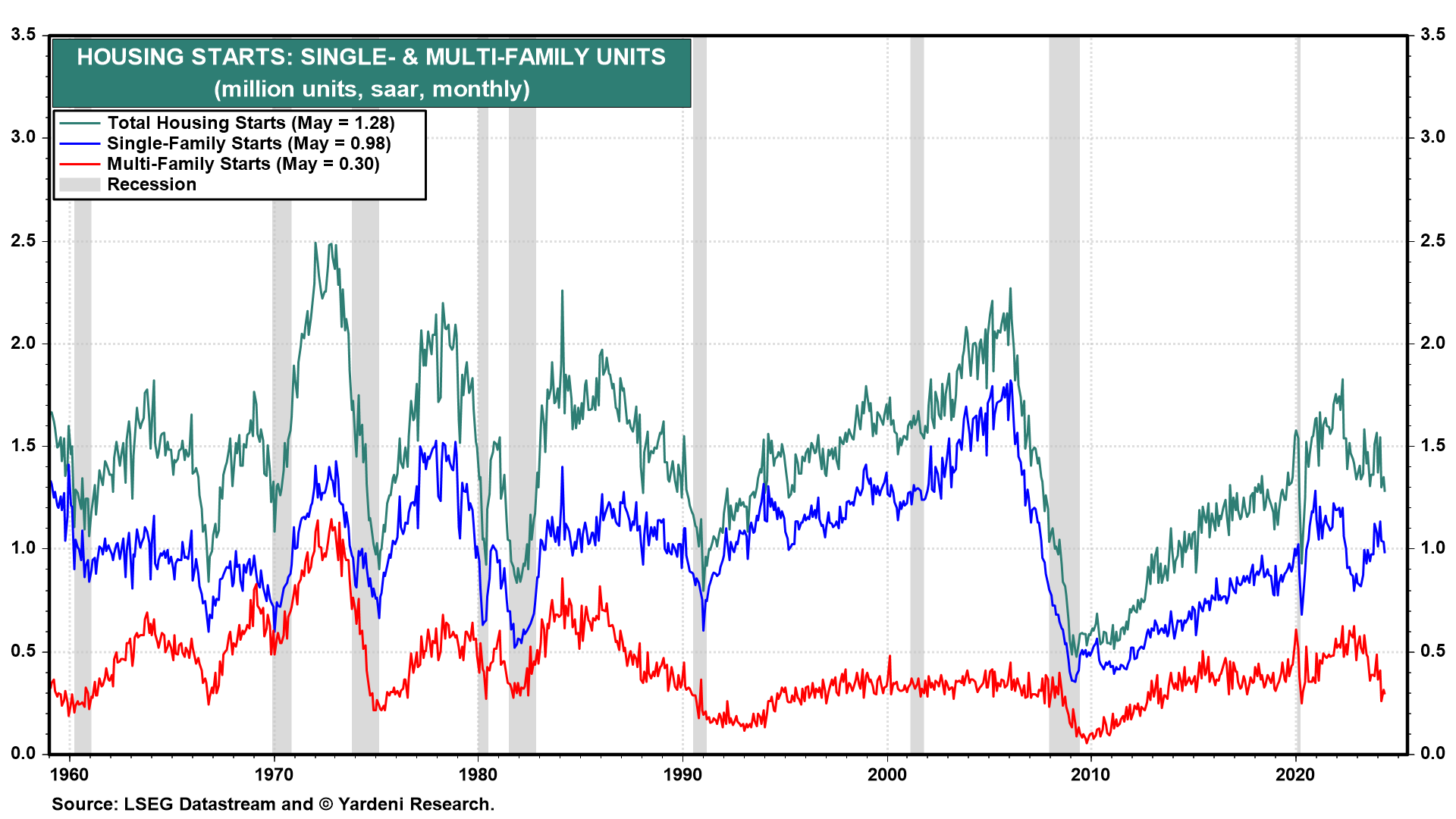

(1) Housing starts & permits. Recent housing starts reports including May's released today showed that the rolling recession in housing has spread to the construction of multi-family units. Over the past 12 months through May, total, single-family, and multi-family housing starts are down 19.3%, 1.7%, and 49.5% (chart).

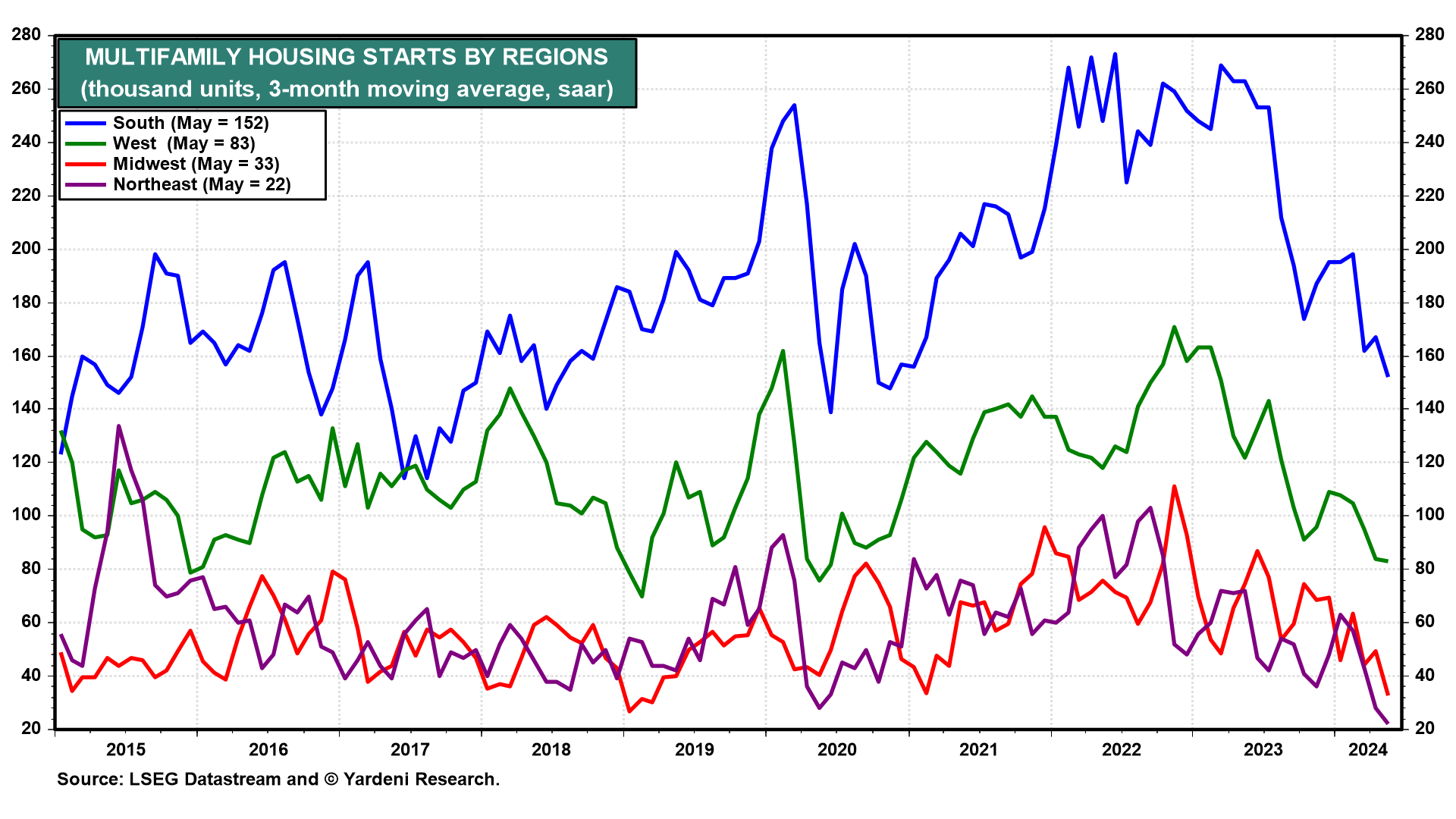

Builders raced to put up multi-family housing units in southern states like Florida, North Carolina, and Texas to meet the post-pandemic demand boom. In recent months, multi-family starts has plunged there and across the country (chart). This suggests that there has been overbuilding, which should continue to depress rent inflation.