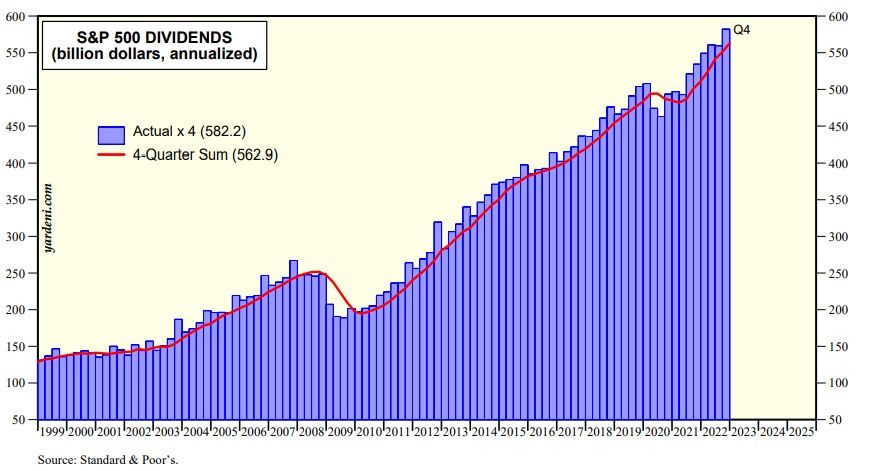

Dividends are like plants. Both grow. But dividends can grow forever, while the size of plants is limited. Notwithstanding last year's bear market, S&P 500 dividends grew to a record high of $562.9 billion during 2022 (chart). Dividends tend to fall during recessions along with profits. There was no recession last year. There may not be one this year.

Money invested in the S&P 500 during 2010, 2000, 1990, 1980, and 1970 would have a current dividend yield of 5.3%, 5.1%, 20.2%, 49.3%, and 77.6% on the original amounts invested at those times (chart). And, of course, the value of the investment purchased at those times would have appreciated along the way too.