Have you heard? Fed Chair Jerome Powell will speak on Friday morning at the Federal Reserve Bank of Kansas City’s annual Economic Policy Symposium, which is held at a nice resort at Jackson Hole, Wyoming.

Odds are he won't change his tune much from what he said in his prepared remarks at his July 27 presser, which was less than a month ago. Since then: July's employment report was stronger than expected with wages still rising rapidly, and July's CPI suggested that price inflation may be peaking but remains too high. Here are a few key excerpts from his presser that he is likely to repeat during his speech on Friday:

(1) "The labor market is extremely tight, and inflation is much too high. .... Overall, the continued strength of the labor market suggests that underlying aggregate demand remains solid."

(2) "Inflation remains well above our longer-run goal of 2 percent. .... [W]e are strongly committed to returning inflation to our 2 percent objective."

(3) "As the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of [rate] increases while we assess how our cumulative policy adjustments are affecting the economy and inflation."

(4) "This process is likely to involve a period of below trend economic growth and some softening in labor market conditions. But such outcomes are likely necessary to restore price stability and to set the stage for achieving maximum employment and stable prices over the longer run."

This time, there won't be a Q&A following his prepared remarks as there was at the presser. The question is will he say that the federal funds rate is currently at neutral as he did a month ago? He'll probably avoid that controversial issue. He might indicate that any expectations that the Fed will ease next year are not consistent with the latest Summary of Economic Projections (SEP) released on June 15.

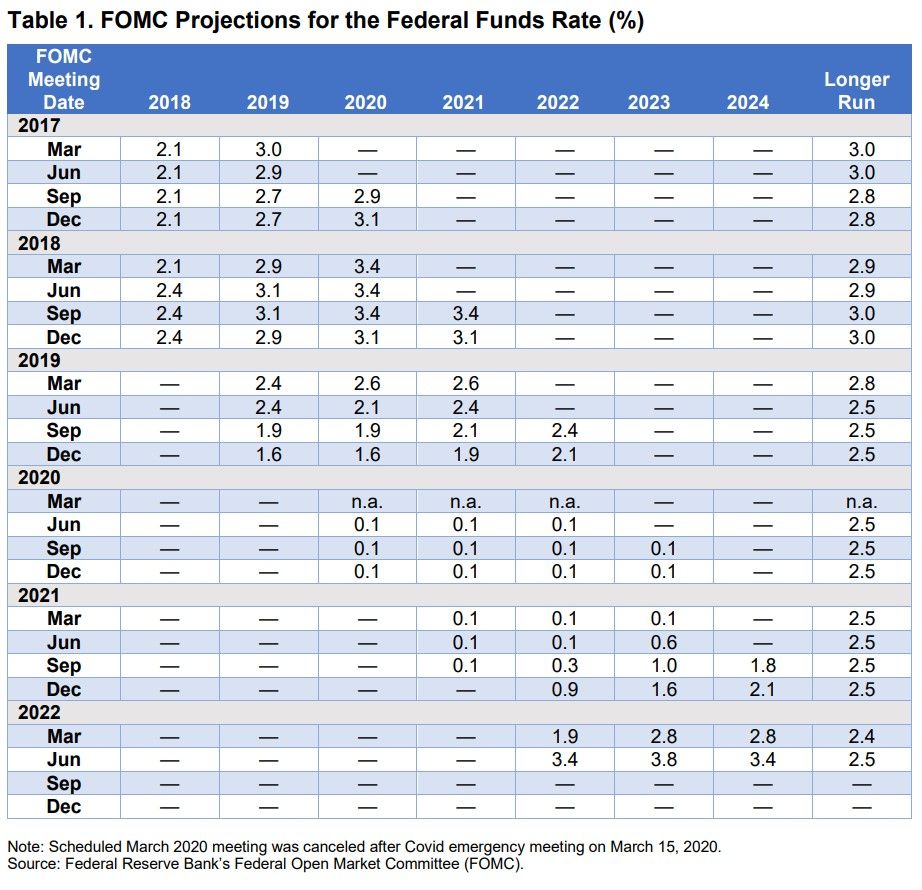

At his presser, he stressed that the "most recent reading" of the FOMC's playbook was June's SEP, which shows the the median year-end 2022 forecast for the federal funds rate is 3.25%-3.50%. That's 100bps higher than the current 2.25%-2.50% range. The SEP showed another 50bps rate hike next year to a range of 3.75%-4.00% (table below).

By the way, Powell mentioned QT2 in passing: "[W]e’re continuing the process of significantly reducing the size of our balance sheet, which plays an important role in firming the stance of monetary policy." He claimed that "[b]y all assessments, the market should be able to absorb this." We will soon find out if that is true as QT2 ramps up during September.