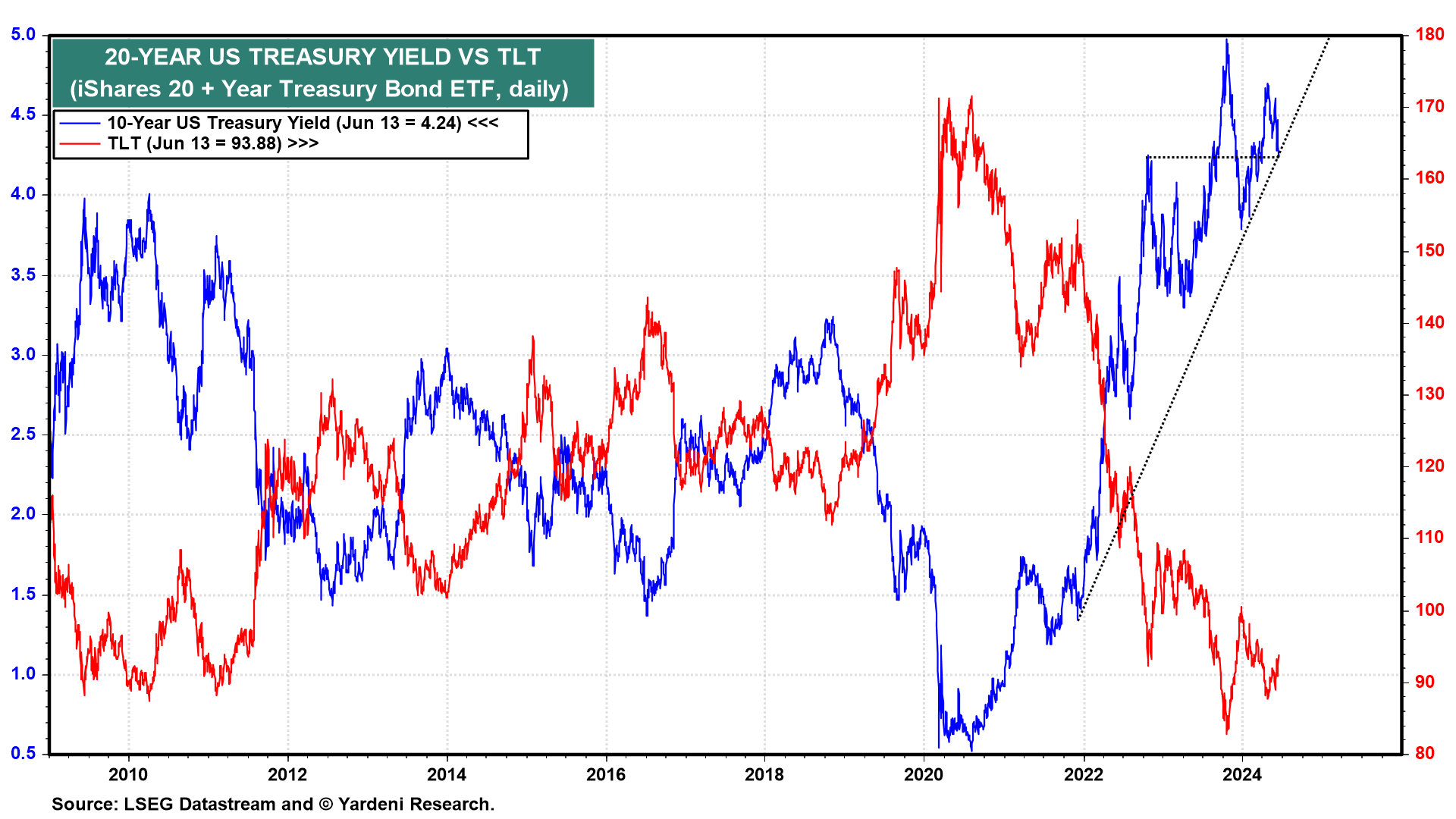

On Wednesday, the Federal Open Market Committee (FOMC) warned markets to expect no more than one interest rate cut over the rest of this year. But the bulls are charging ahead anyway on May's lower-than-expected CPI and PPI inflation data yesterday and today. The 10-year US Treasury bond yield is down nearly 25bps since Monday's high to 4.24% (chart).

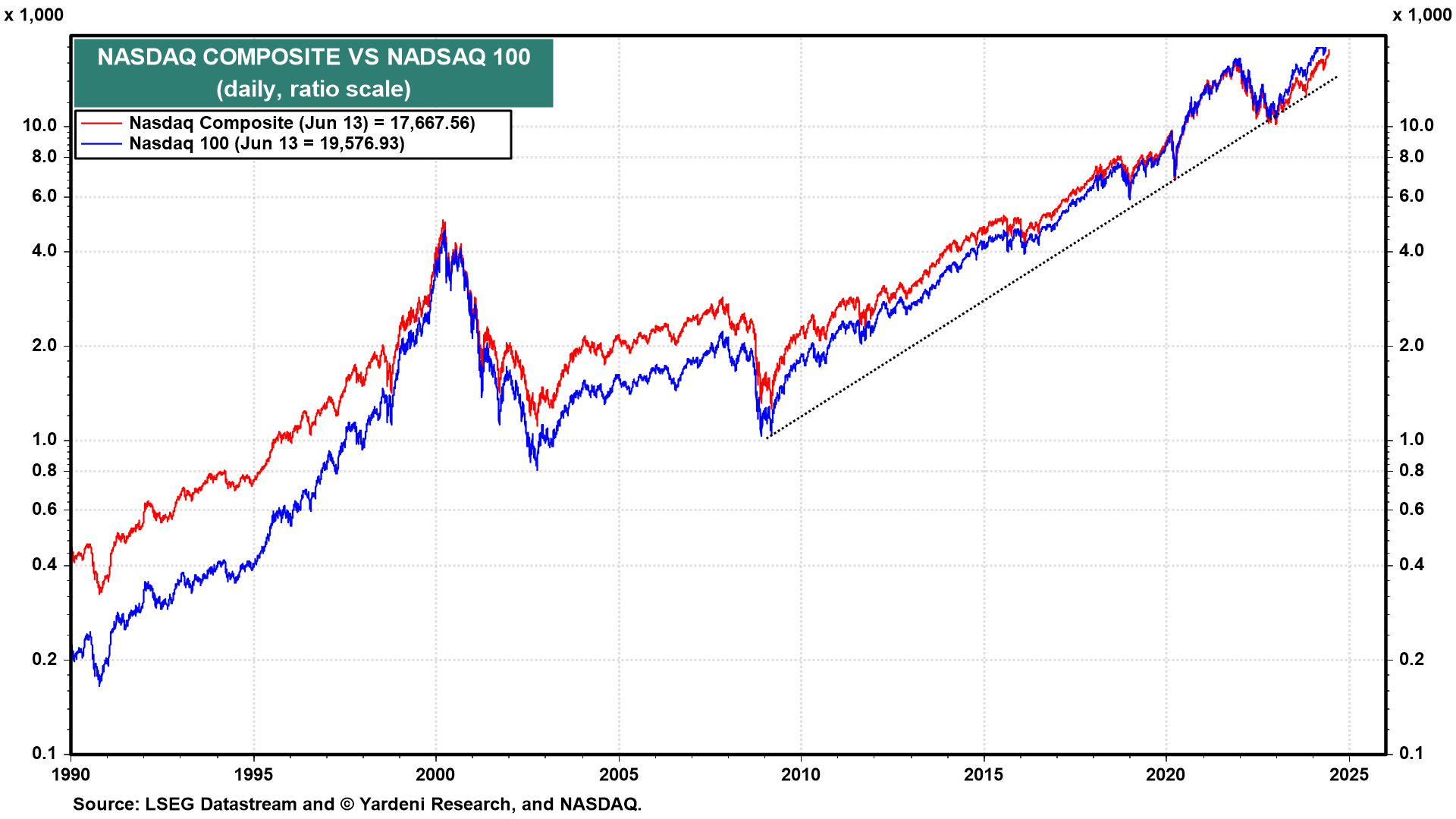

The Nasdaq hit another record high today (chart). Leading the way to new highs is Apple. The company introduced Apple Intelligence at its Worldwide Developers Conference this week. Siri has been supercharged with ChatGPT.

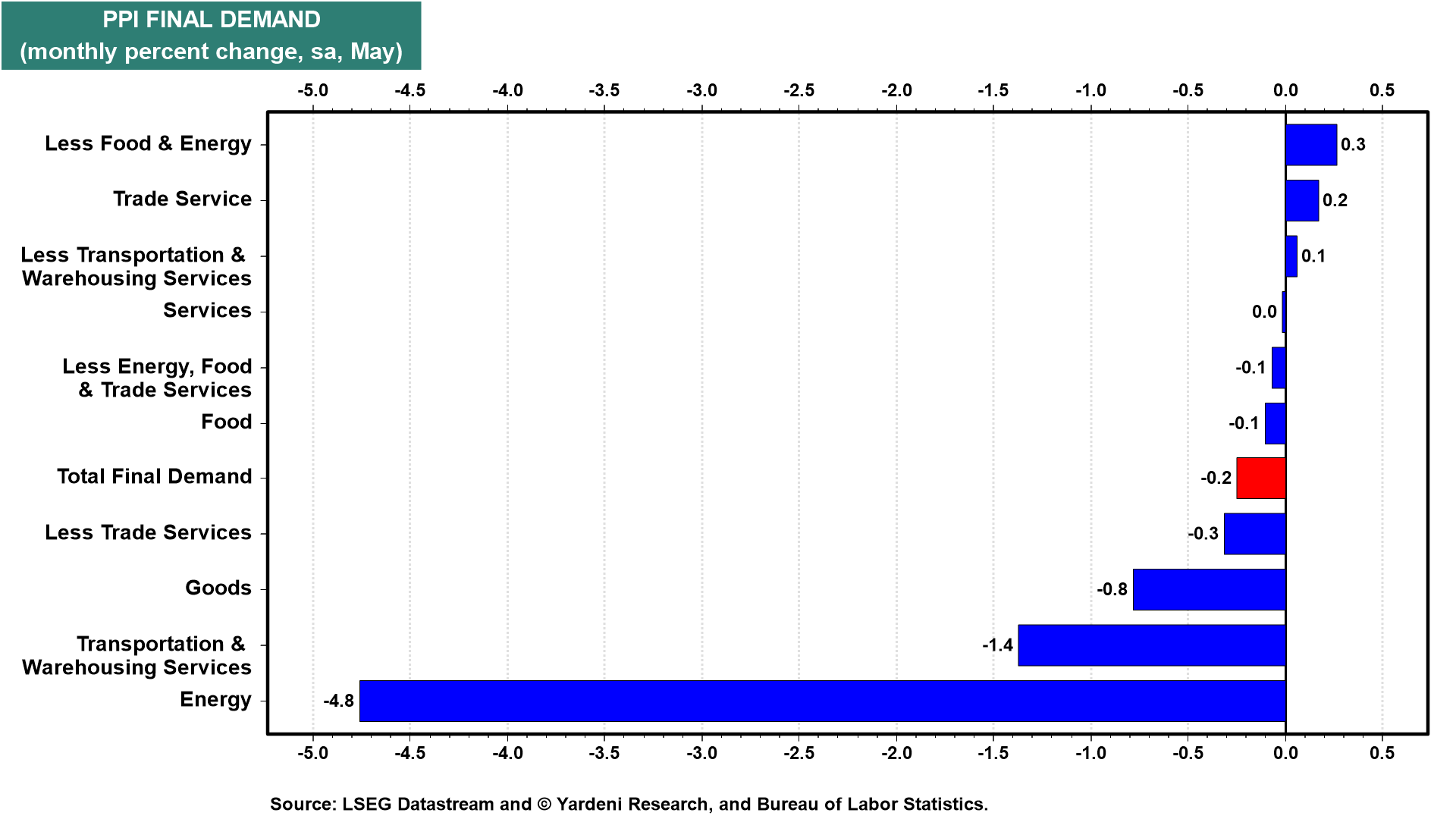

Today's PPI report showed that the producer price index fell 0.2% m/m in May (chart). The drop was led by a 4.8% drop in energy prices. Excluding food and energy, the PPI was up 0.3% and down 0.1% also excluding trade services (i.e., a measure of profit margins).

On a y/y basis, the PPI final demand excluding energy, food, and trade services has been stuck around 3.0% since April 2022 (chart). The PPI final demand for personal consumption (which does not include rent) was up only 2.8% y/y in May.